🛸🛸2025: An Amazon Ad Odyssey

Solo Instamart, Toffee Apocalypse, Banana Snacks, FMCG Speed, Brewing Profits

Hi, Surgies 👋

It’s been the greyest of grey weeks in Gurgaon. Pals over at home were subliminally (like all other alcobev advertising) affected to open a bottle of the grey bird kind.

The D2C world has been anything but dull, with multiple fundings announced in the first week of 2025. Amazon, meanwhile added much more colour to its ad tech vertical. Time to end the colour metaphor and get to the rest of the newsletter…

🔥On Fire This Week

When it comes to ad tech, Amazon is an innovation juggernaut. From better seller tools to new ad inventory, the company is expanding on multiple fronts.

“How can I create an audience of customers who have heard our audio ads, but have not yet made a purchase?” - Amazon Ads announced a SQL generator for Amazon Marketing Cloud (AMC), that provides a natural language interface through which advertisers can generate SQL queries for their desired audience use case – eliminating the need to create the code manually and reducing query development time from hours to minutes. Advertisers then run the queries in AMC to create their new audience and activate the audience in Amazon DSP and ads console.

For brands playing the long game, Amazon’s DSP could soon surpass Google Ads in terms of ROI. With targeted ad placements that follow customers across devices and platforms, Amazon’s DSP offers unmatched visibility and targeting precision. Think about it, Unmatched First-Party Data, Seamless Integration with Retail Media (recently launched), Amazon’s rapidly expanding footprint in Connected TV (CTV) and the homegrown video inventory (Prime and MX Player)

The company has recently launched its Retail Ad Service, taking a major step toward becoming a comprehensive ad tech provider, much like it did with its cloud computing arm, AWS. It allows advertisers to launch Sponsored Product campaigns directly on partnered retail websites and apps, all managed through the Amazon Ads console. This service can potentially become the advertising backbone for e-commerce, just as AWS is for cloud computing.

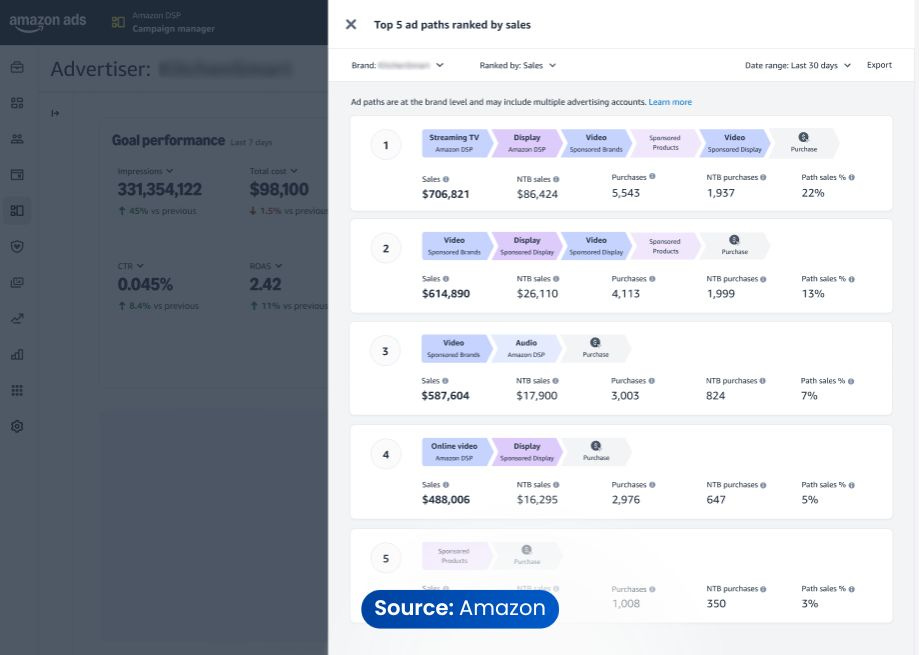

Amazon's Conversion Path Reporting tool which went live recently lets you see the entire 30-day customer journey through your ads, from Sponsored Products to Amazon DSP and even Streaming TV. Amazon finally handed sellers the map to navigate the ad maze.

🗞️Marketplace Buzz

Beauty is Big, but Fashion Should be Bigger: Over the past quarters, Nykaa’s topline has seen an average growth of 25%, with the beauty and personal care (BPC) segment contributing to about 90% of the company’s revenue. The fashion vertical, which was hailed as the growth lever, on the other hand, has struggled to maintain momentum with an average contribution rate of 8.6% to the top line. The fashion segment is projected to achieve a net revenue growth of approximately 20% in the third quarter. With competitors like Myntra and Amazon nipping at its heels, Nykaa will need to be more than just a pretty face.

InstaMart Goes Solo: Swiggy will launch its quick commerce offering Instamart as a separate app (finally!, what took you so long), as it looks to build a multi-app strategy. However, Instamart will continue to be present on the main Swiggy app.

2024 saw the meteoric rise of quick commerce. What once seemed like an ambitious dream—a 20-minute delivery—has now become the standard. Anything slower feels underwhelming. Here’s what the folks at Inc42 think 2025 will look like for this sector.

The real speed of FMCG: Quick commerce platforms now generate approximately 35% of FMCG companies' e-commerce revenue. The industry's expansion has led major organisations to recruit dedicated key account managers to strengthen relationships with quick commerce ventures. A Nestle India spokesperson revealed that quick commerce contributed 60 % of their domestic e-commerce sales in the Sept 2024 quarter.

🍕D2C Snippets

Power shoppers, those placing more than five orders a year, grew by 3X in 2024, jumping from 0.5 million to 1.7 million. This group alone contributed 10% of the total GMV for D2C brands in our network. Power shoppers spent an average of ₹1215 per order, with nearly 19% of them spending up to ₹1999—a 3% uplift from 2023. These shoppers are drawn to products that elevate their lifestyle, showcasing a clear trend toward premiumization according to GoKwik.

Brewing Profits (almost) and Scaling: In the crowded D2C space, finding the perfect blend of growth and profitability can feel like searching for the right tea leaves. Vahdam, has trimmed its FY24 losses by a hefty 68%, bringing it down to ₹18 Cr. Vadham revenue from operations grew by 10.6% to Rs 225.2 crore in FY24 from Rs 203.6 crore in FY23. The USA remained the primary revenue driver, accounting for 68.5% of the total operating revenue. With rising gross margins, the company is brewing a more sustainable business model.

We don’t write much about the Amazon 1P sellers. Let’s change that. Here’s an update from Cocoblu Retail. Impressive numbers coming in with 2.8 Cr books, 1.6 Cr shoes and 2.4 Cr wireless accessories being sold.

Dinnerware brand BlackCarrot, endorsed by Bollywood actress Neha Dhupia, has raised (amount undisclosed) seed funding. BlackCarrot offers innovative, healthier alternatives to traditional dinnerware, including Bone China-free crockery, 304 food-grade stainless steel cutlery, and lead-free glasses. Founded by Yadupati Gupta and Vishal Gupta, the company scaled its operations across various channels, including online marketplaces and quick commerce platforms.

When we talk about the next big thing in luxury skincare, RAS Luxury Skincare is making a serious case for it. The Ayurvedic brand has secured ₹40 Cr in Series A funding. The market for clean, sustainable, and luxury skincare is booming, RAS is looking to dominate the space. Founded by Shubhika Jain, Sangeeta Jain and Suramya Jain, RAS offers beauty and skincare products with natural ingredients and potent scientific formulations, manufactured at the startup’s proprietary vertically-integrated research facility and farms in Raipur, Chhattisgarh.

Beyond Snack, a health-conscious snack brand (think banana chips, but elevated), just raised $3.5M in a Series A funding round. The company is looking to dominate the niche market for healthy snacks in India. Founded by Manas Madhu, Jyoti Rajguru and Gautam Raghuraman, Beyond Snack is a plant-based savoury snacks brand that produces its banana chips with no artificial colours or flavours. Can it maintain its edge over the bigger players like Lays and Britannia? The road ahead looks crunchy, but we’re all in on this one.

New Year resolutions are driving a surge in demand for health and fitness products online.

Noise attributed the festive gifting season and New Year resolutions to a 20% increase in sales of its products such as smartwatches and smart rings.

Swiggy Instamart clocked a 123% jump in orders for protein-based items in the first two days of January

Mumbai-based Tego Fit, specialising in fitness accessories and equipment, noted a 20% rise in demand from Tier II and Tier III geographies.

📚Reads and Recommendations

Remember the six degrees of separation Kevin Bacon game? Try this instead but with photos: connect celebs using photos of them appearing together.

Here’s a great list of the questions VCs ask startups. Go ahead, win the room.🏆 But first prep.

Brands using shoppable videos see a 40% bump in conversions.📈 Check out how tutorials, UGC and quick demos can be used to drive up sales.

The M&A landscape for Consumer Brands in India is on absolute 🔥🔥 right now. Zivame, The Mom’s Co, The Man Company, Clovia, Plix, Minimalist….

How 16.73 billion UPI transactions killed the ubiquitous toffee business.😵 Indian shopkeepers always had a “chutta nahi hai” or “no change available” mindset. This transition to digital payment skips the requirement of shopkeepers to keep candy or toffee in handy in exchange

That’s all for this week! Bye!

Folks at some companies have told us this newsletter is almost mandatory weekly reading for their teams 🥰. If your company is not in on it yet, get your teams on the latest in the e-commerce space every week.

Liked this week’s issue? Share it with your pals.