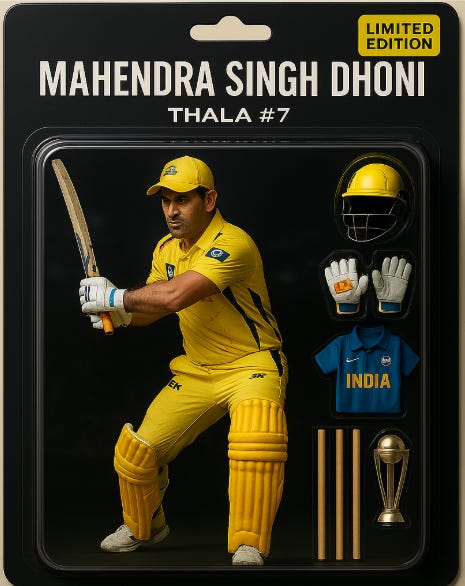

MS Dhoni just walked in as the CSK captain again, and the timeline lost it. No LinkedIn carousel, no founder speech, just the silent swagger. The man doesn’t pivot. He returns. But then there’s CSK's current form ☹

With Thaala-mode activated, let’s get into this week’s D2C heat. From VC love to export infra, from sleep IPOs to IG’s lockable posts, this one’s loaded.

🗞️ Marketplace Buzz

Amazon India is stepping up for the folks behind the fast deliveries by expanding its Ashray centres—safe, well-equipped rest stops for delivery personnel—to 100 locations across the country. What’s cooler? These aren’t just for Amazon’s own fleet—they’re open to all delivery workers, offering essentials like water, charging stations, first aid, and clean loos. Because e ven delivery heroes need a break🛵💼✨

Summer is upon us - a friendly reminder to everyone. Please offer water to the delivery heroes battling the heat when they come over with your package.

In a season where VCs are ghosting faster than Hinge dates, AgroStar just scored fresh funds from existing backers; no pitch decks, just pure conviction. While everyone’s chasing D2C dopamine, these guys are quietly owning Bharat’s distribution stack with agri-tech that actually sticks.

Cross-border logistics startup Xindus just raised $10M to grease India’s export engine. While most startups chase last-mile chaos, Xindus is flipping the funnel, building a full-stack OS for cross-border trade.

Speaking of cross border, as the US tightens checks on Chinese imports, Indian e-commerce sellers are being handed a golden export opportunity. According to GTRI, categories like textiles, electronics, and consumer goods could see a big boost as US buyers hunt for non-China options. Time for Indian D2C brands to shine on the global stage—because when one door closes (on China), another opens (straight to the US cart). 🛍️💸

Zepto isn’t just zipping groceries—it’s zooming past milestones. The quick commerce upstart is now clocking a $4 billion annualised Gross Order Value, tripling its numbers from last year like it’s on creatine and caffeine. But wait, there’s fiscal finesse too—Zepto has halved its cash burn in the last 3 months. CEO Aadit Palicha says EBITDA break-even is just months away. That’s right—profitability might just be 10 minutes away too.💰

🍕 D2C Snippets

Home-grown lifestyle luggage brand Fur Jaden just zipped up ₹9.5 cr to go from airport aesthetic to ₹100 cr ARR. The company plans to establish a pan-India presence over the next five years through a combination of digital expansion, flagship stores, and strategic retail partnerships.

Innovist bagged ₹136 cr and gave Accel the cleanest exit in personal care. With ICICI Venture stepping in, it’s proof that having your own factories (and not 3PL band-aids) still wins.

Outzidr just raised ₹30 cr to crack Gen Z fashion, but it’s not about fast fits. They’re betting on real-time demand, not warehouse roulette. Founded in 2024 by fashion veterans Nirmal Jain, Mani Kant Mani, and Justin Mario, the company aims to hit an annualised revenue run rate of Rs 100 crore in the next 6 to 8 months.

boAt is done playing on aux—it's going full surround sound with its IPO filing, eyeing a thumping ₹12,000 Cr valuation. From bass-heavy earphones to wrist-hugging wearables, the D2C darling wants to rock the public markets next. India’s favorite D2C audio brand is turning up the volume on growth—and if all goes to plan, boAt will be publicly listed and properly lit. 🔊🔥

Eat Better Co. just raised ₹17 cr to turn your 4PM cravings into clean-label habits. They're stacking Ayurveda, convenience, and macros into a snack brand that doesn’t just sound healthy, it tastes like traction. The “good for you” snack wave is peaking.

Another day, another munch-money raise. Snacking brand Let’s Try just bagged $2.5M to scale its salty hustle. From legacy Indian flavours to modern packaging, it’s aiming to be the Bhujiya 2.0 brand your pantry didn’t know it needed.

Noise just turned the volume up, Bose dropped another $20M. This isn’t just capital, it’s a power move. From frenemies to full-throttle partners, Bose doubling down means Noise isn’t playing in the budget aisle anymore.

Mosaic Wellness just locked in $20M at a tidy $400M valuation. Two brands, real repeat buyers, and dermat plays that actually deliver, it turns out D2C skincare isn’t just hype and retargeting. TAM was never the issue, building trust was. Looks like Mosaic cracked it.

Wakefit’s IPO dreams are now official, ₹200M target, three bankers already locked. But the real story isn’t the raise, it’s the slow burn. Profitable growth, category creation, and sleep as a serious category. The mattress wars just went public.

📢Power Talk

“For the top 50 cities and the more affluent user base, we will lead with speed, service, convenience, and national brands…And the moment you come down to the next customer segment, we lead with selection and value, and make sure speed-related service becomes hygiene,” - Kalyan Krishnamurthy, CEO Flipkart

📚 Reads & Recos

Even faster fashion. Walmart is tapping into generative AI to speed up how fast it rolls out on-trend fashion items. The company claims the proprietary “trend-sensing design tool” can shorten fashion production timelines by as much as 18 weeks.

Lock kiya jaaye! Instagram’s trying out a new way to drive engagement with your followers, with lockable posts, that can only be unlocked with a code.

The Biyani Comeback: Retail king’s daughters are staging a comeback new brands.

The UK banned fake reviews and hidden fees for online shopping platforms, including food delivery and ticketing sites. Officials estimate such tactics cost UK consumers ~$2.8B per year.

🔥That’s all for this week! As always, share this with your fellow D2C hustlers, and let’s keep the community growing.

Folks at some companies have told us this newsletter is almost mandatory weekly reading for their teams 🥰. If your company is not in on it yet, get your teams on the latest in the e-commerce space every week.