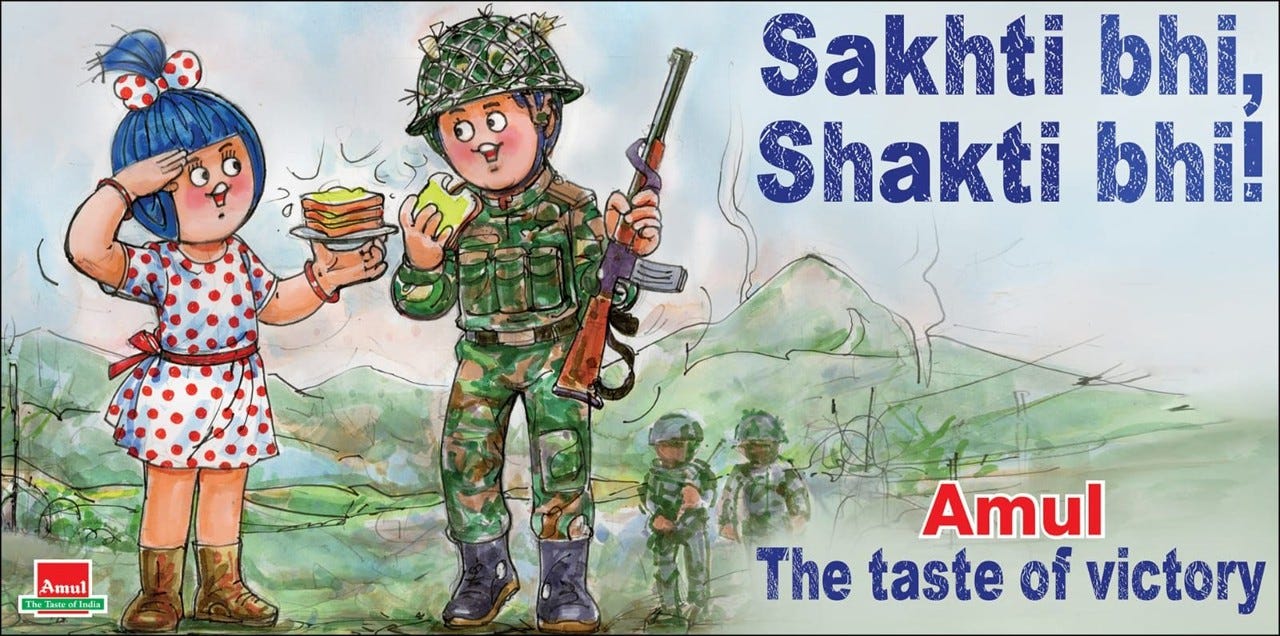

🇮🇳 this week, we salute the real frontline heroes. While our feeds volley memes and stats, some wins aren’t about scorecards. They’re about courage, clarity, and showing up when it counts. The Amul girl’s salute says it all. We’re proud. We’re grateful. And we know what real pressure looks like.

Back to our turf now- the world of D2C, q-comm chaos, and capital that moves faster than fashion drops. There was a flurry of calls last week, multiple founders and performance marketers were asking, ‘ROAS dip hua kya?' Looks like there was an impact.

🗞️ Marketplace Buzz

Porter becomes 2025’s second unicorn with its latest series F round. No new playbooks, no distractions, Porter’s still betting on logistics, scale, and staying essential to India’s delivery backbone. This one is less about fuel and more about firepower.

Unicommerce’s backend might be boring, but that’s exactly why it works. It clocked 70% YoY growth in Q4 FY25, stayed profitable, and didn’t need a flashy pivot to do it. In the e-commerce world obsessed with front-end flair, Unicommerce makes the back office look like the real unicorn play.

Hyper-local isn’t cute anymore- it’s the new national. From Tamil beauty ads to Marathi WhatsApp support, brands are going pin code-first and language-led. Forget mass reach. The new playbook is micro-resonance. Brands are rewriting playbooks: one pin code, one dialect, one micro-moment at a time. This isn’t about ticking a “regional” box anymore, it’s a core scale lever.

Digital tax is here, and it’s anything but plug & play. India’s digital tax landscape is turning into a compliance minefield. The rules are changing faster than your GTM plan, from equalisation levies to platform liabilities. D2C brands, marketplaces, and SaaS players better keep up or get slammed with backdated bills.

NEWME and Slikk are ditching warehouses for dark stores—and fashion’s getting the 10-minute treatment. These startups are pushing ultra-fast delivery, fresh drops, and try-at-doorstep returns. Inventory turns in 90 days, collections drop weekly, and freshness is the new fashion KPI. Speed is the new SKU filter. But the real test? CAC and burn don’t care about your outfit changes.

Shiplog just raised ₹6.5 Cr and it’s gunning for 4-hour domination. The Delhi startup snagged the seed cash to scale its dark-store-led, 4-hour delivery engine- built for D2C brands. Tiny cheque, but if they pull it off, it’ll punch way above its weight.

D2C brands take note: Meta doesn’t just want your ad budget- it wants your marketing team. Zuck’s vision, per this LinkedIn post- Tell Meta your goal, plug in your card, and AI runs everything- copy, creative, targeting, and measurement. For small brands, it’s a superpower. For big ones, it’s a black box with your brand inside.

🍕 D2C Snippets

The Good Bug just raised ₹100 Cr, and it’s not just gas. Susquehanna Asia and Fireside Ventures led this probiotic round. Gut health is no longer niche, and this brand’s betting big on science + scale to make digestion cool (and VC-backed). They’re now pushing GLP-1 hacks, R&D expansion, and a kombucha-meets-kefir wellness stack. India’s D2C gut game just got a serious bloating of capital.

Troovy raised ₹20 Cr, because maida and sugar are out of syllabus. Fireside backed the brand to rewire kids’ nutrition without the junk. Think pasta, milk mixes, and snacks that read clean labels like school toppers. The brand’s pitch is clear: win over parents with ingredients and win over kids with taste. If they get both right, this isn’t a snack-it’s a category. And yes, they did not forget to add the protein.

Blissclub raises ₹45 Cr- still in shape, still in the game. While at a flat ₹570 Cr valuation, in this market, no markdown is a flex. With Elevation, Eight Roads, and Alteria backing the round, and travel wear now in the mix, BlissClub’s still betting that movement-first fashion has serious legs. Flat cap? Sure. But the brand's form hasn’t broken.

📢Power Talk

“Getting a sale is easy. Getting a quality sale is very difficult” - Peyush Bansal, Founder, Lenskart

📚 Reads & Recos

AI won’t take your job, but lazy takes might. This essay shreds the doomer script. AI isn’t replacing everything. It’s not even that good yet. The real threat? Thinking automation kills creativity, or that Chatgpt will write your strategy. The real risk isn’t AI replacing marketers, it's marketers fearing the tools.

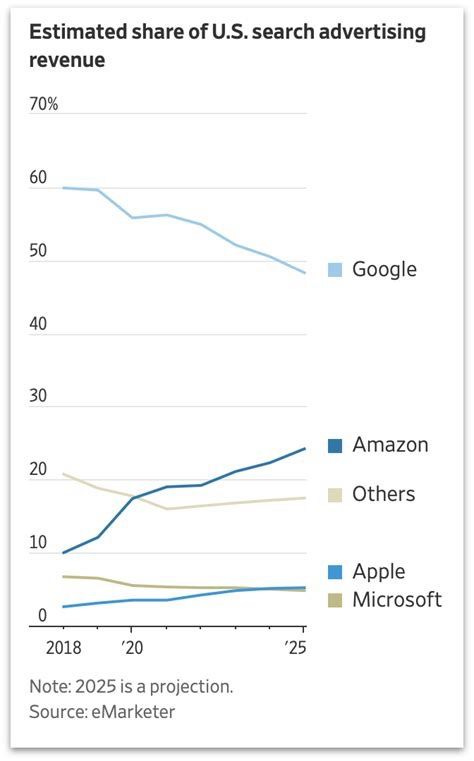

We’re not typing queries, we’re chasing answers. The truth bomb: Google lost $ 200 B+ because search isn’t default anymore, it’s decentralised. As this chart shows, the “just Google it” era is fading. People now ask AI, scroll TikTok, trust Reddit, and lean into creators. For CMOs, this flips the funnel. You don’t win by bidding at the bottom; you win by showing up at the source of curiosity.

Martech just dropped its 2025 bible from HubSpot’s Scott Brinker. This isn’t a trend roundup- it’s a teardown of how AI is reshaping marketing ops, stacks, and roles. The 2025 Martech Landscape shows a stack exploding in tools and imploding in structure. AI agents, hypertail customisation, and new-age ops teams are rewriting the rules.

Following the end of the de minimis exemption last week, UPS and Fedex anticipate a notable revenue drop as shipments of low-cost goods from China to the US make up a significant portion of the delivery companies’ businesses.

That’s all for this week! Bye!

PS: Folks at some companies have told us this newsletter is almost mandatory weekly reading for their teams 🥰. If your company is not in on it yet, get your teams on the latest in the e-commerce space every week

Just discovered your newsletter and I have to say: "excellent curation. top notch writing 🧡"

Would love an essay or write-up from you on the influencer marketing space and if it's even effective for most brands.