👕Fashionable Tale of a Rabbit Kind

Cracking the Offline Code, Makhana Mainia, Gifting Galore, Coffee Takeaways

Hi Surgies 👋(A warm welcome to the 100+ D2C Founders and Operators who signed up this week)

Looks like the sale season lit up D2C Land.

D2C brands recorded an impressive 64% growth in orders from last year during the recent sale period, compared to 26% growth seen on the marketplaces as per a report by GoKwik, an ecommerce enablement company. While beauty, personal care, and fashion segments along with categories such as television typically dominate the sales as far as the festive season sales are concerned, niche categories such as festive hampers, décor items and personalised jewellery too have managed to attract the consumers this time around.

The AOV for D2C brands also saw an 11% jump year on year. Tier2,3 cities led the charge in demand growth. Consumers opted for UPI for mid-range products while higher-end purchases have attracted the EMI mode of payment, which in general has indicated the shift towards flexible payment methods. As per the report, there was a 5% increase in prepaid orders.

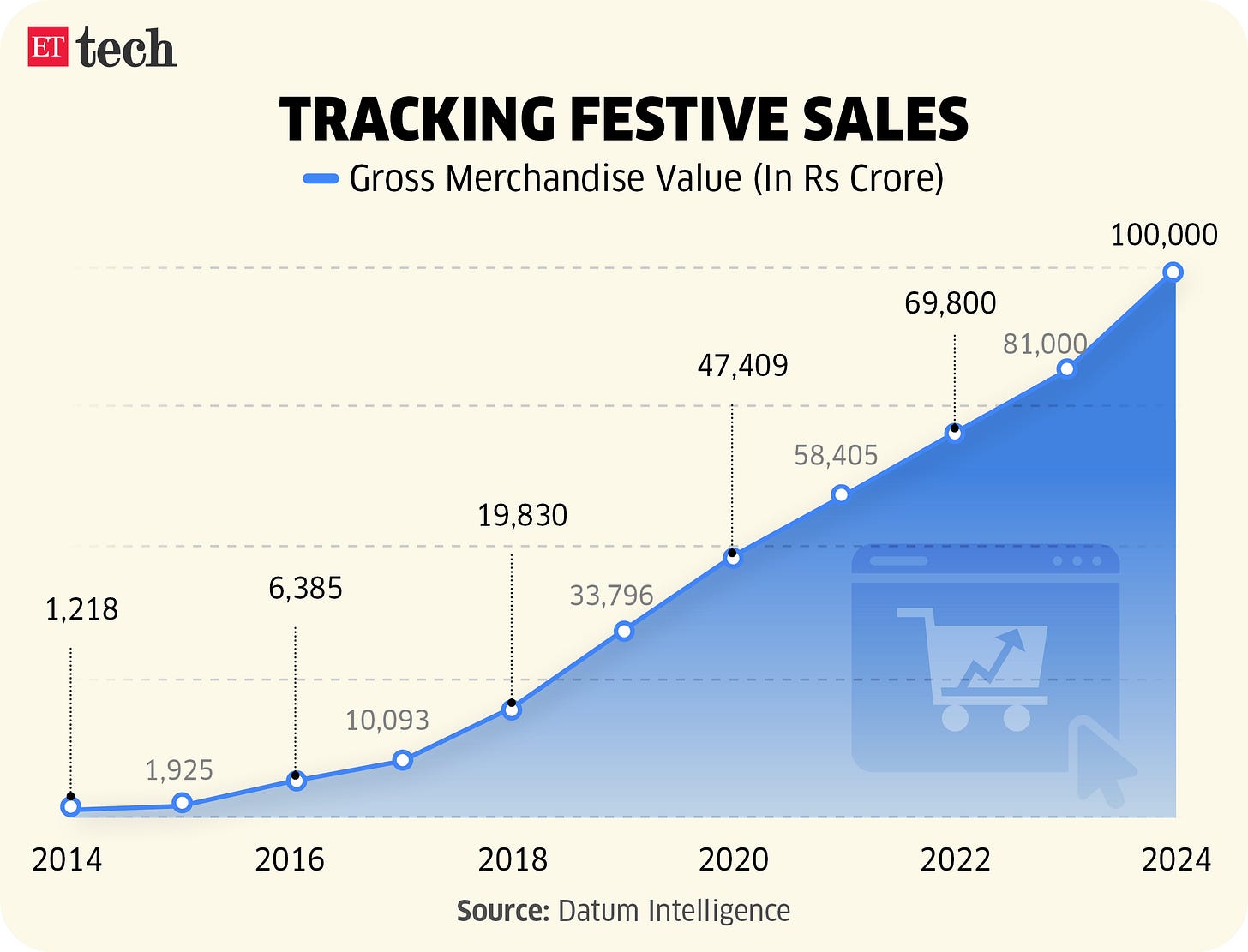

Overall the ecommerce numbers were staggering with sales ending at $11 Billion for the festive month. Key points to be discussed at the coffee station today:

More than half the demand came in the first week itself

Demand for premium large appliances grew by 30% over last year

Fashion and beauty premium portfolio saw an over 400% spike

85% of Amazon customers were from non-metro cities

Meesho saw a 105% YoY growth in the home and kitchen category

Quick commerce accounted for about $1.1-1.2 billion in sales this festive season.

🗞️Marketplace Buzz

Flipkart’s FY24 advertising income was noteworthy at Rs 5,000 Cr. The marketplace arm of Flipkart, reported revenues of Rs 17,907 Cr for FY24, up nearly 21% year-on-year, while its losses fell 41% to Rs 2,358 Cr.

Meesho’s revenue jumped 33% to Rs 7,615 crore in FY24. At the same time, Meesho's adjusted losses narrowed sharply by 97%, to Rs 53 crore, down from Rs 1,569 crore in FY23. The platform saw 145 million unique annual transacting users, with a marked increase in order frequency, especially from underserved non-metro markets in India. Logistical enhancements also fueled Meesho’s FY24 improvements. Earlier in February, Meesho introduced Valmo, a dedicated logistics arm aimed at reducing shipping costs and enhancing delivery speed.

While Amazon’s India marketplace unit is yet to file its audited financials with the Registrar of Companies (RoC), earnings of the other arms indicate a slowdown in Amazon’s India business amid increasing competition from rivals like Flipkart and Meesho.

Amazon Transportation Services (ATS), the company's shipping arm in India, clocked a 7.6% increase in operating revenue to Rs 4,889 Cr in FY24 from Rs 4,543 Cr in FY23. Its net loss narrowed marginally by 6.9% to Rs 80 Cr from Rs 86 Cr during the period.

Amazon Pay reported a middling revenue growth, generating Rs 2,286 crore in FY24, up 9.2% from Rs 2,093 crore in the previous year, while reducing its loss by 39% to Rs 911 crore. Amazon Seller Services, which runs the US ecommerce giant’s local marketplace, is yet to file its FY24 results.

Quick Commerce Gold Rush: The “trinity” of Blinkit, Swiggy Instamart and Zepto appear to have leveraged their first-mover advantage in the space to cultivate strong brand recognition and capture a big chunk of the market share.

Meanwhile, a new wave of quick commerce players and adopters continue to spawn:

BBnow - Planning a deployment of 500-600 dark stores nationwide, which will work alongside its 56-60 large warehouses.

Flipkart Minutes - Piloted in Bengaluru in August. Subsequently, the company expanded its quick commerce offerings to Delhi NCR.

Amazon India - Plans to roll out its quick commerce vertical in the first quarter of 2025

JioMart - Piloting instant delivery of groceries and FMCG in some parts of Mumbai and Navi Mumbai.

Myntra - Plans to launch 4 hr delivery for Bangalore and Delhi

Nykaa - Launched a 10-minute delivery pilot in select parts of Mumbai, covering 5% of its SKU base

Slikk - The fashion ecommerce platform claims to deliver branded apparel items within 60 minutes in select locations of Bengaluru and claims to be catering to about 100 users per day

Tata Neu- Set to enter the quick commerce segment branded as Neu Flash. For grocery deliveries, Neu Flash will utilise BigBasket while Croma will provide electronics and mobile phones, and Tata Cliq will manage fashion and lifestyle products.

🍕D2C Snippets

Fashionable Tale: The Rare Rabbit story is amazing. It's a Rs. 3000 Cr brand built in a short time ( Co. started in 2015) by Manish Poddar, who cold-called his way into Inditex (Zara). Yeah, his dad ran a textile business, but Manish took it to the next level. Check out a short read that covers 50% layoffs, building resilience through an omnichannel strategy, and scaling yearly revenues to Rs. 700+ Cr profitably.

Not So Shiny: Mellora is in a bit of a spot with an unfathomable 94% fall in valuation from Rs. 1,000 Cr (in mid-2022) to reportedly being acquired in a fire sale by publicly listed jewellery giant SENCO Gold. Founded in 2015 by former Titan executive Yeramailli, Melorra quickly rose to prominence with its pitch of lightweight jewellery for daily usage. A delayed omnichannel entry and stiff competition affected the company adversely even though it was a first mover in the jewellery space once upon a time.

Fan-tastic Growth: Consumer appliances brand Atomberg reported an over 31% growth in its operating revenue in the fiscal year ending March 2024. The company’s revenue from operations rose 31.5% to Rs 848 crore in FY24 from Rs 645 crore in the previous fiscal year. The non-fan business contributed 7 cr of revenue in FY 24. But looking at the current excellent growth trajectory of the kitchen appliances and smart locks business, the company claims to be on track to deliver exceptional growth in these categories in FY 25.

Gifting Galore: Multi-category gifting company IGP is planning to expand its presence in the online as well as offline space by opening 140 dark stores and 22 retail stores in the next year.Currently, the company boasts of 60 dark stores in 28 cities. Apart from this, the brand is also planning to expand its presence in the international markets. At present, it has a presence in Dubai, Singapore, and the US and delivers to 102 countries from India.

📢Power Talk

Quick commerce is now about pricing & assortment, not speed.

-Sriharsha Majety, Co-founder and CEO, Swiggy

🚩Insights

Coffee Takeaways: Some interesting insights by Matt Chitharanjan, Co-founder of Blue Tokai Coffee Roasters. Here’s the TLDR:

Opening up a single location in a new city was not useful or beneficial.

Operating a small kiosk and a large cafe requires almost the same operational intensity. You still need to do all the quality auditing, training, and setting up the supply chain. “This means that we'd rather open 25 1000-square-foot stores than 100 250-square-foot kiosks. If we're putting in all that effort, we might as well channel it towards a larger-format store that can deliver five to six times the revenue of a smaller kiosk.“

One of the key elements of scaling to 100+ offline locations is scaling talent, service, and culture.

Cracking the Offline Code: When does a D2C brand need to ‘go offline’? How do the unit economics and pricing play out for general trade, modern stores and company-owned stores? Here’s an interesting take

Meanwhile, Arindam from Atomberg has a great framework for when to ‘go offline’ with a PMF lens. “Ideally, only after you experience product-market-price-fit on D2C or e-commerce channels. You know that your product is accepted and wanted in the market at the price you’ve kept, and offline channels will only accelerate growth.” Yeah, there are telltale signs that there’s a PMF on online channels - Category share>10%, Ratings >4.3, Higher Conversion Rate, High Repeats…

📚Reads and Recommendations

😋Makhana Mania: 85% of the world's makhana production takes place in Bihar. A Deep Dive into India's INR 8.5 Billion Makhana Industry

🪙58% of India's gold is held by families earning less than ₹5 lakhs per annum. Jewellery is no longer reserved for special occasions. The market has seen a notable shift towards daily wear pieces, with average price points moving from ₹50k-1L down to ₹3k. Here’s a ready reckoner on the jewellery market trends by Sharrp Ventures

📊Is the urban economy slowing down? Here are the corporate signals

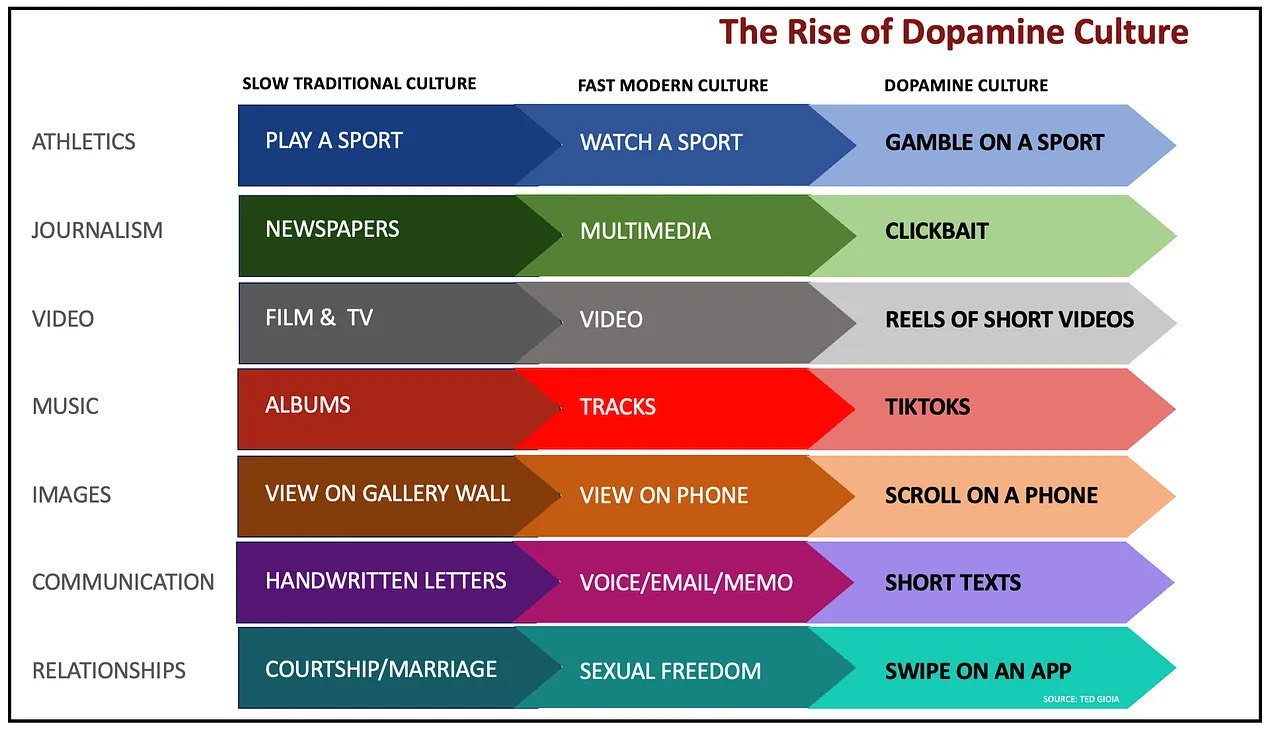

📺Dorito-fication of media. The human mind wasn’t meant to deal with “weapons-grade distraction” non-stop throughout the day. It’s not just the social media apps. It’s streaming services, video games, messaging, sports-betting platforms, dating apps and online investing tools. They are all designed to capture our finite attention and all are available in our pockets, at the tap of a button.

Can this be extended to Shopping?: A walk to the Kirana store → Marketplace Shopping Apps like Amazon, Flipkart →Quick Commerce

That’s all for this week! Bye!

Folks at some companies have told us this newsletter is mandatory weekly reading for their teams 🥰. If your company is not in on it yet, get your teams on the latest in the e-commerce space every week.

Stay tuned for more.

Liked this week’s issue? Share it with your pals.