The man who worked everywhere, all at once. Soham Parekh isn’t just a guy who held 3 (or 34?) jobs at once; he’s the glitch in the matrix that every founder assumed didn’t exist. He clocked into multiple full-time roles without anyone catching on… until they did.

And as X sharpened its knives, Nishant Mittal’s Substack gently reminded us: maybe this isn’t about deceit, but about how blurry the lines have become between survival, ambition, and overemployment in a low-trust society running on jugaad and job-juggling. Is Soham Parekh the logical product of a system that rewards output, ignores oversight, and quietly prays no one checks the backend? He gamed it. They let him. Now everyone’s acting surprised.

And while Soham’s saga unfolds, the rest of the ecosystem isn’t sitting still- it's adapting, fundraising, tightening its grip, and rewriting the rules.

Whether it’s moonlighting engineers, vanishing margins, or rewriting return policies, one thing’s clear: in a system this scrappy, trust isn’t given, it’s engineered. Let’s get into it.

🗞️ Marketplace Buzz

Meesho plots a ₹4,250-cr silent slingshot to Dalal Street and just slipped a confidential DRHP under SEBI’s door to raise fresh ammo. With Elevation, Peak XV, SoftBank, and Prosus already lining up for a partial cash-out, the OG-social-commerce-now-marketplace unicorn’s message to Flipkart and Amazon is clear: profit discipline isn’t a buzzword- it’s the IPO battering ram.

Myntra just rolled out Glamstream, a slick content-to-commerce engine blending creator drops, live tutorials, and influencer edits into one tap-to-shop feed. And it looks like a full-blown bet on turning scrolls into spends without making users leave the stream. With over 4,000 videos already live and creators showcasing everything from makeup to streetwear in fashion, whoever controls the eyeball funnel owns the checkout. It’s been tried before by others, with multiple failures, but that's what we do in the e-commerce world. We get up and try again. Maybe this time it’s different.

Swiggy’s new crew wants to be your hyperlocal concierge, not just your lunch guy. Swiggy’s Crew lets users summon luxury candles, rare ice cream, or even your maa ke hath ka tiffin from across town. It’s a sharp pivot from 10-minute delivery to 1-hour anything, signalling that in a crowded Q-comm war, the next frontier isn’t speed- it’s service with memory.

Gobblecube gulps $3.5M to plug your revenue leaks before the CFO smells smoke, and spot margin leaks before they flood your P&L. 200+ big guns already pay for Gobblecube’s "where-the-hell-is-my-money" engine that parses billions of hyperlocal signals to patch price gaps, spike digital-shelf rank, and intercept basket thefts before they steal your lunch. Nine months in, it’s already clocking $2M ARR, and with this new ammo, it’s coming for every founder’s leaking funnel mess and disappearing profits.

No-questions-asked? Not anymore. India’s e-commerce giants are quietly shifting from customer delight to survival tactics as return fraud balloons to ₹15,000 crore, bleeding margins and forcing Myntra, Amazon, and quick-commerce upstarts to flag “serial swappers,” slash return windows, and even impose ₹299 fees. These moves could gut 50% of a D2C brand’s GMV if founders don’t wake up to dodgy sizing, zero try-ons, and checkout roulette.

🍕 D2C Snippets

Antinorm slings a 3-SKU missile at India’s 10-step beauty gospel and just swapped term sheets for serums. With a product range that promises “less product, more impact” for women battling pollution, humidity, and heat, and a ₹5-crore VC ammo, Antinorm is betting that minimal SKUs plus climate-hacked formulas will snatch shelf space.

Fitfeast bulks up with ₹5.5 cr of protein power. This Gurugram-based upstart has crashed into your scroll with macros and Malai Kulfi. Backed by cricketers-turned-ambassadors and fresh off a Shark Tank flex, it’s already clocked ₹50L in monthly sales. The game plan is a quick-commerce blitz and a flavour lab assault because in this market, the first brand to combine protein and taste and distribution and format in the same bite wins the shelf war.

Cookd raises $600k to turn recipe reels into full-cart conversions. And it’s not here to be your next recipe app- it’s gunning to hijack the entire dinner flow: hook you with a reel, one-tap you into buying the ingredients, then upsell you Cookd-branded masalas before ITC or HUL can even warm the stove.

📢Power Talk

“Fashion discovery today is increasingly driven by social feeds and cultural influence, yet much of that inspiration remains disconnected from the path to purchase.” Sunder Balasubramanian, CMO, Myntra.

📚 Reads & Recos

Apple turns college kids into $2K MacBook closers with a free 81-slide pitch deck. Instead of another back-to-school discount, Cupertino just weaponised its biggest fans: a “Why I Need a Mac for College” template - that trains broke students to sell their parents a ₹1.7-lakh MacBook.

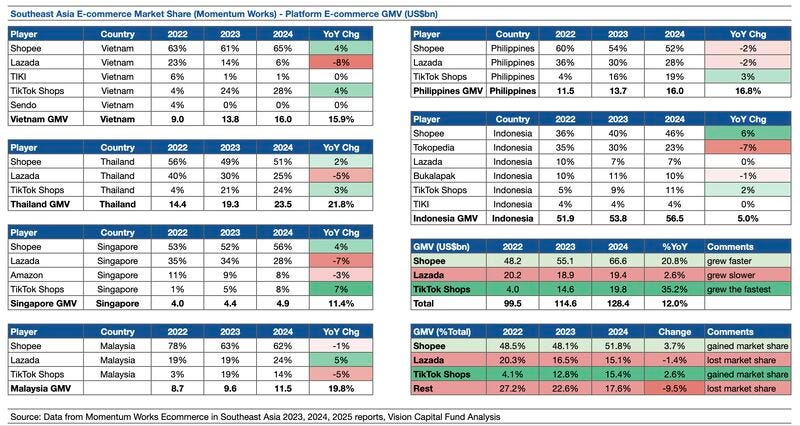

SE Asia’s ecommerce league table, surfaced via this LinkedIn chart drop, shows Shopee muscling to 51.8 % share after a +20.8 % YoY surge and TikTok Shop blitzing +35.2 % to seize 15.4 %. Lesson for founders- social-fuelled checkouts are eating breadth-first marketplaces, and speed, not SKU sprawl, is the new moat.

30% of your Q-comm ad budget is probably bleeding. This crisp LinkedIn breakdown drops a reality check for every brand blindly copy-pasting ad strategy across Q-comm platforms.

Prime just crashed from $1.2B to brand burnout because hype doesn’t come with repeat rate. The KSI–Logan Paul juggernaut that roared to $1.2B in year two just nosedived: UK sales down 70%, profits off a cliff, and repeat rate stuck at 12% This LinkedIn teardown rips the lid off: 90,000 store rollouts before product–market fit and Gen Z clout without parental wallets. Here’s the tattoo: hype is the spark, but loyalty is the core engine.

That’s all for this week! Bye!

PS: Folks at some companies have told us this newsletter is almost mandatory weekly reading for their teams 🥰. If your company is not in on it yet, get your teams on the latest in the e-commerce space every week