👶🏽HUL Birthing D2C Founders

Malaki's soda power, Blinkit's going inventory first, Jiomart's 30 min play

A warm welcome to the 400+ new subscribers who joined us this week. Let’s get started with…

Paani mein protein mil chuka hai! Amul just turned its kulfi into a gym bro and dropped 10g of protein in everything from lassi to milkshake- served with zero chill- and the internet lost its mind. Just a meme wave so wild that the memes themselves are the distribution strategy for Amul.

Of course, this edition is all protein. Scroll fast. Lift heavy. Let’s go.

🗞️ Marketplace Buzz

IndiaMART’s Q4 flex is about profits without the drama. Q4 FY24-25 net profit surged 81% YoY to ₹180.6 Cr, with revenue at ₹355 Cr. No flash, just frictionless cash. It’s compounding revenue off the back of verified suppliers and boring billing cycles. Indiamart isn’t chasing the spotlight; it’s building the plumbing.

Blinkit bets inventory-first. Quick-commerce darling Blinkit is ditching asset-light vibes to go full-stack. Why should you care? Because last-mile now means inventory control, not just delivery speed. Flipkart, BigBasket, your turn to sweat.

ONDC keeps postponing fees- charity or fear? ONDC’s pushed its network fee rollout again. Great for sellers, awkward for investors and the translation? ONDC is still walking on eggshells around its ecosystem. Infra without a revenue model isn’t sustainable. It’s scale is waiting on a spreadsheet.

Small brands are burning fast to win faster. With Tata IPL in full swing, D2C challengers are jumping into quick commerce to hijack eyeballs. It’s not cheap, but it’s instant. TV still costs crores. Quick commerce costs lakhs, but gets your SKU into carts faster than your reel loads.

Reliance isn’t chasing q-commerce, it’s resetting the terms. JioMart is now shifting to a 30-minute delivery model, repositioning its grocery game as quick commerce heats up. When giants re-enter the ring, it’s not to play catch-up, it’s to rewrite the scoreboard. Online retail has been a bit of a hit and miss for he retail giant to date. Let’s see how this goes.

🍕 D2C Snippets

Sauce VC just backed Uni-Seoul with ₹5 Cr to bottle Seoul’s vibes for Indian shelves. Sauce VC’s bet? India’s affordable luxury market isn’t saturated; it’s underserved. And a brand that blends cultural aspiration with daily utility might just crack it. This isn’t another sheet mask play.

Malaki just popped a ₹5.7 Cr round to spike your soda shelf with swagger. The Shark Tank alum says the funds will fuel ops and product innovation. No mass-market cola vibes here. Quiet round, niche thesis: make wellness drinkable, aesthetic, and Instagrammable.

Ultrahuman’s SoftBank flex just got a pass. The wearables brand is now in talks with WestBridge to raise $100–120M, after the SoftBank deal apparently fell through. India’s health-tech poster boy isn’t done sweating yet, and the glucose grind continues. Strap in.

Nat Habit’s revenue is up 80% to 72 Cr in FY24, but losses are still chilling. Nat Habits sells ancient wellness wisdom in millennial packaging, but looks like ops needs a detox, with losses holding flat at ₹17 Cr. It’s a classic D2C trade-off: revenue’s glowing, margins still in purging mode

Anveshan’s ghee is hot, and so is the cap table. Wipro Enterprises is leading a ₹48 Cr round into the D2C natural food brand, which clocked a ₹100 Cr revenue run rate in FY25 but is still loss-making. This isn’t a Blitzscale story. It’s a founder-led FMCG bet built on clean labels, deep sourcing, and actual conviction.

Kult isn’t building a beauty brand, it’s building the algo behind your next serum. With a $20M funding, the startup is betting big on a data-led, hyper-personalised platform that sells precision, not palettes. In a sea of sameness, Kult wants to own what others outsource: recommendation, retention, and relevance.

The Souled Store just ate Redwolf, and it’s not just for the fan art. This move isn’t about scale, it’s about building moats in meme merch. With Redwolf in the bag, Souled Store isn’t chasing more customers, it’s locking down licences. In pop-culture D2C, distribution is cute, exclusivity is king.

Kalki just raised ₹225 Cr to scale the shaadi season like a startup. Lighthouse Funds has backed the bridal and occasion wear brand as it doubles down on premium ethnic play. With stores, exports, and celeb-powered recall, Kalki’s betting that luxury lehengas can go from boutique buzz to national business.

Powerhouse91 just hit ₹100 Cr ARR, with none of the funding burn. The D2C aggregator has hit EBITDA profitability on $2.5M raised earlier, scaling with tight ops and sharper execution. This is what compounding without chaos looks like in a market drunk on cash. No theatrics, just ops, patience, and margin math.

The Bear House proves you don’t need noise to build a ₹140 Cr brand. The men’s fashion startup has scaled profitably and earned loyalty with a 65% repeat rate. In a category obsessed with marketplaces and margins, this one built quietly and kept the shirt. Sometimes, a good shirt just wins.

Salt just raised $1M to make brushing your teeth feel like a brand choice, not a chore. Salt's play is clear in a category ruled by boring tubes and legacy trust; turn oral care into a design-led ritual. The packaging slaps, the vibe’s clinical-chic, and your regular toothpaste’s namak has started sweating.

📺Brandwagon

The throwback ad by Renee ‘caught our eye’. Dunno how much the GenZish TG will relate to this though.

📚 Reads & Recos

Everyone loves top-funnel drama, but the real knives are out at checkout. Brands are carving out dedicated e-commerce mandates, hyper-focusing on conversion rates, ROAS, and last-click wars. Mass reach is cute; smart money’s going where wallets open. Full dissection here.

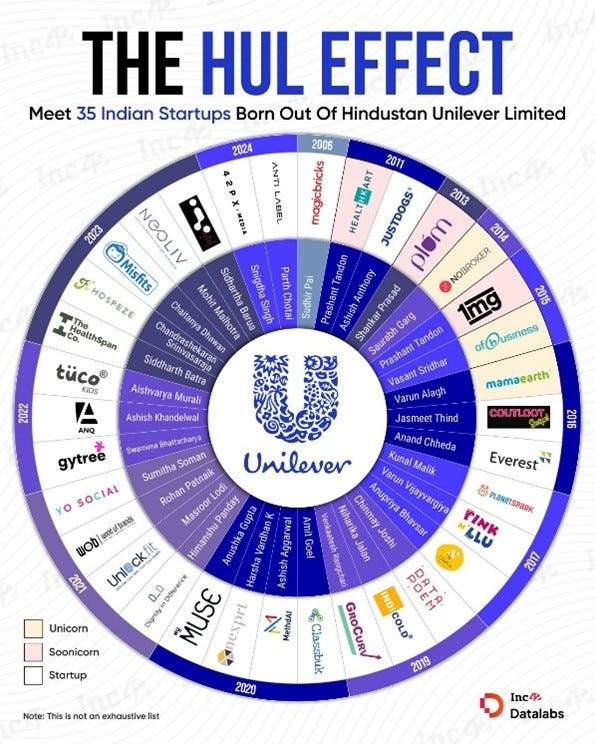

Not YC. Not Blume. The real unicorn factory? It’s called Hindustan Unilever; HUL is the original startup school, and this chart proves it. 35 Indian startups- all founded by ex-HUL operators who swapped sachets for startups.

Here’s a quick explainer on Meta’s new video editing app, which takes on Capcut

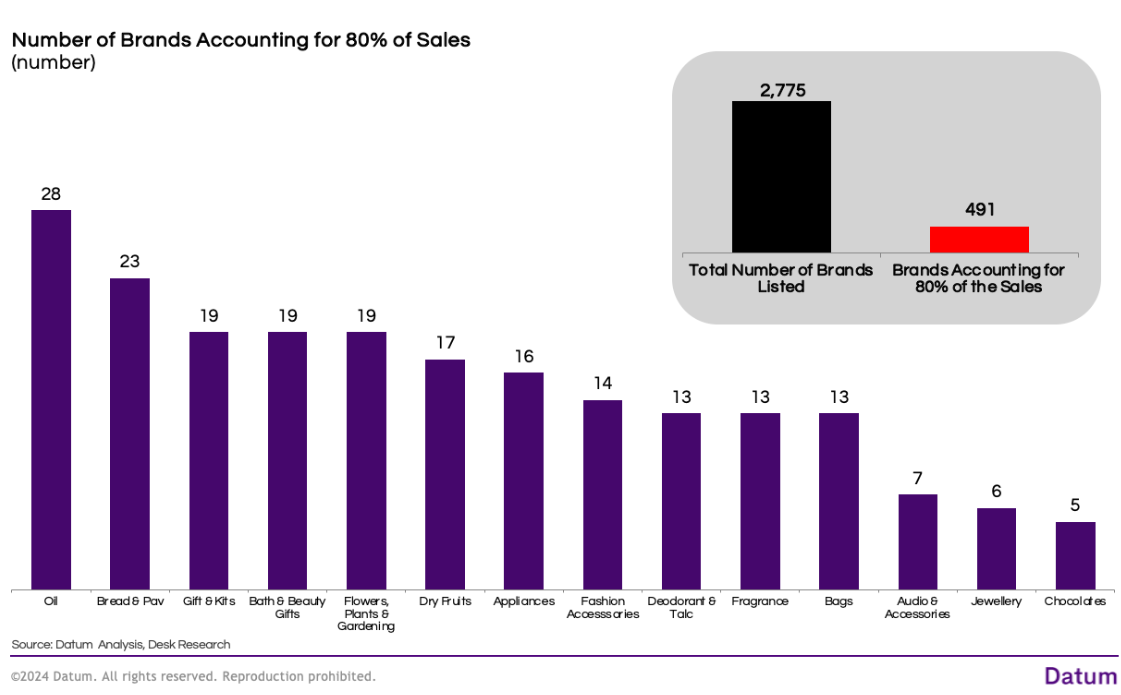

At the platform level, Blinkit follows a classic Pareto Principle (80/20 rule): Among 2,777 brands listed, only 491 brands account for 80% of total sales. The good folks at Datum further broke this down for key categories. Tread with caution, all ye folks in D2C world, brand recall pull in the sales here.

🔥That’s all for this week! As always, share this with your fellow D2C hustlers, and let’s keep the community growing. I know it’s a day late, but it’s important to wish fellow galactic travellers a Happy Star Wars Day!

PS: Folks at some companies have told us this newsletter is almost mandatory weekly reading for their teams 🥰. If your company is not in on it yet, get your teams on the latest in the e-commerce space every week.