While Gurgaon (almost) drowned in a 4 hr rainfall event this week, Tier-3 cities hit “add to cart” on India’s e-commerce boom, clocking a 21% YoY sales surge and snatching a hefty 38% share of all online orders this summer. While metros still lead with 42%, Bharat’s shoppers are powering the next wave—snagging deals on electronics, home décor, beauty, and books (hello, 200% growth!). Tier-2 and Tier-3 are now the hottest battlegrounds for D2C and retail giants. Forget metro-first—India’s e-commerce future is proudly small-town and unstoppable.

🗞️Marketplace Buzz

Meesho’s recipe for e-commerce domination? Penny-wise hustle with rupee-smart moves. Meesho leads all ecommerce apps in downloads across India, including quick commerce and food delivery. Thanks to its Valmo logistics magic and zero-commission swagger, Meesho thrives on tiny orders that pack a big punch. With 187 million bargain hunters from small towns on board, Meesho has snagged 37% of India’s e-commerce pie as per this report. In this game, it’s not just about big bucks—it’s about big hustle with small change, proving thrift can be the ultimate power move.

Infra.Market just played a power move in the tile game, snapping up a majority stake in Metro Group with a ₹200 crore share swap that’s got the industry talking. With over 16 factories in Morbi and a tile-making muscle of 60 million sqm a year, Infra.Market is stacking its chips high for India’s building boom and its own IPO runway. This isn’t just another brick in the wall—think vertical integration, export ambitions, and a high-margin hustle that’s putting rivals on notice. As Infra.Market lays down tiles, it’s also laying the groundwork for a future where it’s the one to beat.

Zepto’s quick-commerce rocket is about to get a $500 million turbo boost, sending its valuation soaring to a jaw-dropping $7 billion. But this isn’t a solo sprint, Zepto’s fundraising dash comes as the quick-commerce race heats up. Eternal’s Blinkit and Swiggy’s Instamart are gaining ground, with Blinkit even overtaking Zepto in daily users and order volumes lately. Meanwhile, BigBasket and Flipkart Minutes are flexing their brand muscle, expanding into new categories like large appliances to nibble away at the leaders’ market share. In this D2C surge, Zepto’s not just fighting for speed, it’s fighting to stay in the fast lane.

Speaking of speed, Amazon just crashed the quick-commerce party in Delhi, rolling out its 10-minute delivery service, Amazon Now, and turning up the heat on Zepto, Blinkit, and Swiggy Instamart. Once the king of next-day delivery, Amazon’s now chasing instant gratification, promising everything from groceries to gadgets at your door in less time than it takes to brew chai. Backed by a ₹2,000 crore investment to build a dark store army, Amazon is gunning for 300 hubs across major metros by year-end.

FSSAI just crashed the e-commerce food party with a hygiene mic drop: “Show us your licenses, or it’s game over!” Platforms now have to flash their FSSAI license numbers on every invoice, memo, and digital receipt—no more hiding behind the checkout screen. Want to keep selling samosas? Upload warehouse selfies, spill the beans on your food handlers, and make sure everyone’s done their FoSTaC food safety homework

Blinkit is flipping the quick-commerce script with a bold new seller model: starting September 1, it’ll hold inventory and sell directly to customers, taking regulatory and compliance headaches off sellers’ plates. No more juggling multiple GST registrations or scrambling for state-specific FSSAI licenses—sellers can now operate with just one GST and let Blinkit handle the paperwork, logistics, and tax maze. Inventory moves from the seller’s books to Blink Commerce Private Limited, while sellers still control listings and pricing, and commercial terms stay the same.

🍕D2C Snippets

WiseLife just flexed its funding muscles, raising ₹8 crore in a pre-Series A - hot on the heels of its Shark Tank India S3 sweep (yes, all four sharks bit). Founded by Prateek Kedia, WiseLife is on a mission to make India’s yoga mats and wellness gear as stylish as they are sustainable. The fresh funds will power new product launches, content-driven community moves, and a distribution blitz. With the yoga mat market set to hit $2.2B by 2033, WiseLife wants to be the go-to mat for every asana and Insta yogi in the country

Wellopia just scored an ₹8 crore seed round. Launched just six months ago, Wellopia is on a mission to make clean, science-backed remedies for little ones cool (and actually tasty). With India’s kids racking up 1.5 billion sick days a year and a ₹40,000 crore market growing at 12%, Wellopia’s timing is spot on.

Binny Bansal’s Opptra just rolled out the royal welcome mat for Tower, the UK’s 110-year-old homeware legend, now landing in India. Forget passport stamps- air fryers, pressure cookers, and sleek gadgets are coming straight to your kitchen. Opptra will also be manufacturing and assembling Tower products within India. The exclusive deal means British design meets Indian budgets, with Tower’s cult favourites hitting online shelves and premium stores. Tower’s arrival is set to stir the pot. British chic, now just a click away.

Ammarzo’s going from “What to Wear” to “What to Dream In”. The Mumbai-based D2C label, once known for its denim and winterwear, has tucked in its fashion-forward roots, pivoted and woken up in the sleep wellness lane. The new goal? Hit ₹100 crore revenue by FY30 and make “good night” a global greeting.

As it heads for IPO, Wakefit isn’t just another D2C brand going public—it’s a vertically integrated, capital-efficient retail machine, showing India how to turn mattresses into monopoly moves. The real moat? Wakefit owns its backend—five manufacturing units, 12 fulfillment centers, and 85% of sales through its own channels, not marketplaces. Check out a next DRHP breakdown.

AMAMA’s handcrafted, soul-packed pieces just bagged a cool $1 million. Founder Nikita Gupta is on a mission to turn traditional Indian craftsmanship into the ultimate flex for the global stage. With fresh funds, AMAMA’s opening new stores in Mumbai, Ahmedabad, and Delhi NCR, while gearing up to take their bling beyond borders—think travel retail and international exhibitions. Basically, they’re turning “Made in India” into “Must Have Everywhere.”

Divine Hindu just gave “omnichannel” a spiritual twist, raising ₹1.56 crore in seed funding. The Indore-based brand, founded by the Singhai brothers, is on a mission to make certified Rudraksha, Tulsi malas, puja kits, and sacred bling as easy to order as your next pizza—thanks to Amazon, Flipkart, Blinkit, and more.

Interesting insight here by Saptarishi Sen - Marico is showing legacy FMCG giants how to play the D2C M&A game- and win. Its acquisitions of Plix, Beardo, True Elements, and Just Herbs have turbocharged Marico’s new-age portfolio to a ₹750 crore ARR, now making up over 25% of total revenue, with a blazing 70% YoY and 25% QoQ growth. Plix leads the pack (and is already EBITDA positive), while Beardo and Just Herbs both clock ₹100 crore+ each.

📚Reads and Recos

India’s creator economy is like a blockbuster sequel: 35–45 lakh creators star, but only 6 lakh get the paycheck credits. he real moneymakers? Reels and Shorts, turning viral moments into brand deals. Instagram hosts the biggest party with 30–38 lakh creators, while YouTube Shorts is quickly stealing the spotlight. Brands, especially in FMCG and e-commerce, are pouring in budgets, but with so many creators vying for attention, it’s a tough game. Most creators are still hustling for sustainable income, proving that in this digital arena, going viral is easy—but making it pay takes serious skill and strategy.

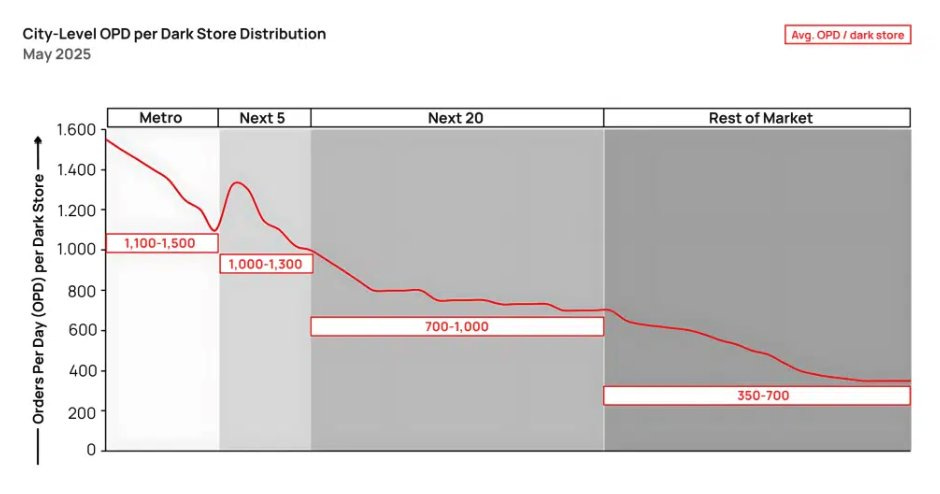

Orders Per Day Per Dark Store- key metric for QCom players is not playing nice in non-metros. Redseer’s report covers how non-metros haven’t lived up to the expectation of QCom players as per Sajith Pai

Retailers raked in $7.9 billion in online sales during the first 24 hours of Amazon Prime Day in the USA, an increase of nearly 10% year over year. This year’s Prime Day is landing at an uncertain time for retailers and consumers as they grapple with the fallout of President Donald Trump’s unpredictable tariff policies.

Crawl efficiency is the backbone of visibility. The longer your site’s been around, the more digital clutter it collects: dead pages, endless redirects, orphaned content, bloated JavaScript, and duplicate URLs. Forget keyword stuffing—if your site’s technical SEO is a mess, even the best content won’t see the light of Google’s day.

🔥That’s all for this week! As always, share this with your fellow D2C hustlers, and let’s keep the community growing.

PS: Folks at some companies have told us this newsletter is almost mandatory weekly reading for their teams 🥰. If your company is not in on it yet, get your teams on the latest in the e-commerce space every week.