🔥How’s The Sale Going?

This is a question which pops up when two folks from e-commerce bump into each other at the 10 km mark of the half marathon, a house party, event or poker table.

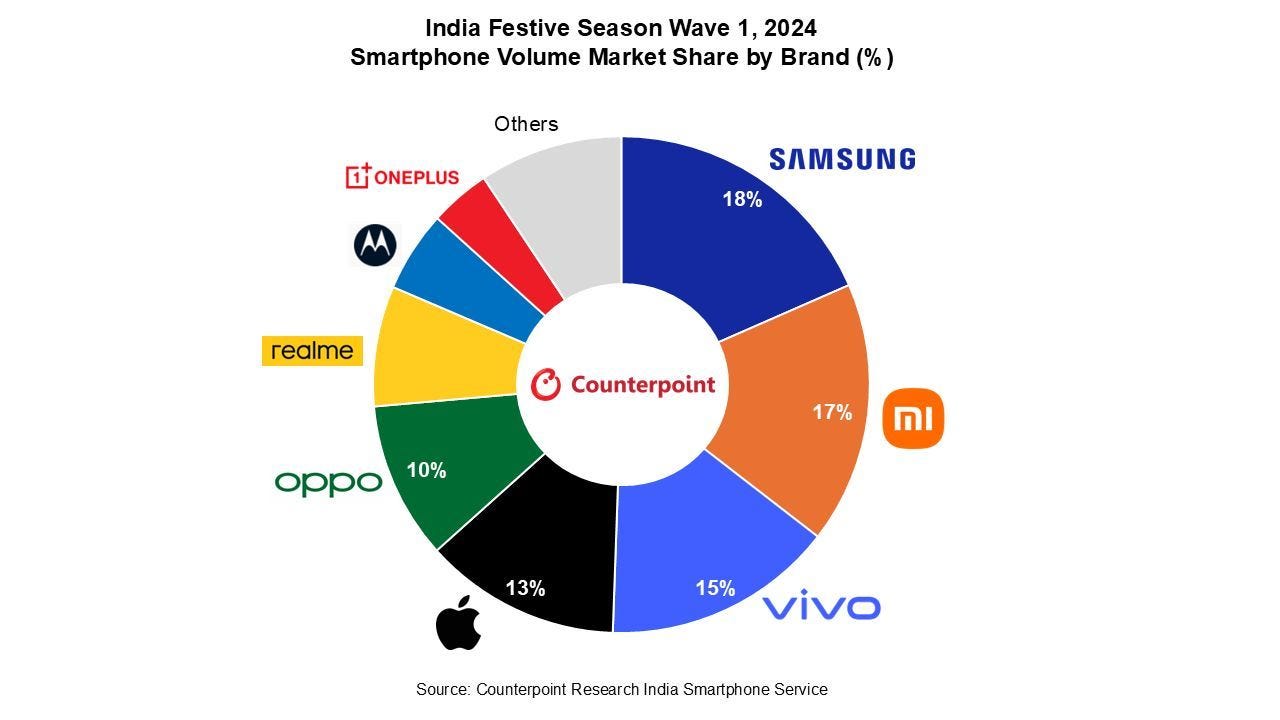

There’s ample buzz on how Flipkart has seen a huge uptick across categories. Premiumization is still a theme. Mobile phones are key to any sale season, here’s what the folks at Counterpoint are saying (TLDR: a slight 3% YoY volume decline in mobile phones, Samsung led in both volume (18%) and value (22%) share, Premium smartphones (>INR 30,000) grew 7% YoY)

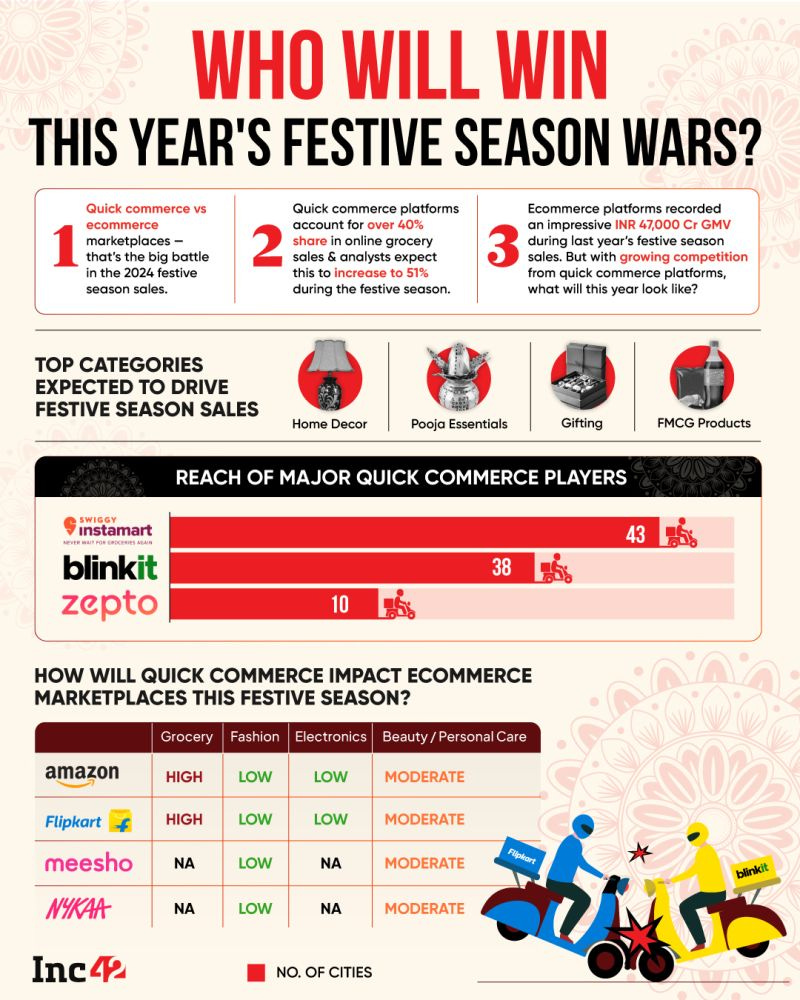

Then there’s the spectre of Quick Commerce which is already impacting the e-commerce marketplace runner’s pace in the half marathon. Quick commerce platforms are expected to make a dent in the fashion, beauty & personal care, and lifestyle segments since these categories cater to impulse shopping. Minimal impact is expected in the electronics and appliances space given that EMIs play a big role in these categories. (Until QComm folks decide to launch the EMI feature too?)

Meanwhile, Amazon is expecting an uptick in two-wheeler sales. The company now expects to introduce the "entire range" of petrol-powered two-wheelers in the next one or two quarters.

🗞️Marketplace Buzz

Offline’s the Way: India's D2C brands are increasingly establishing a presence in malls to boost customer engagement and create immersive shopping experiences. This trend extends beyond major cities to tier-2 cities, aligning with the growing demand for experiential retail and premium shopping spaces. Industry players point to malls as the ideal platform for brands to build a tangible presence, foster connections, and drive profitability.

It’s Getting Hotter: Quick commerce is not a 2 or 3 player market any more… In a few months, it will turn into a 7-player market: Instamart, Zepto, Blinkit, BBNow, Flipkart Minutes, JioMart, Amazon.

QC is rapidly moving in the fashion category. Yeah, a tracker’s live on which brands are live on QC (beyond fashion)

🍕D2C Snippets

Meat Me Offline: D2C meat and seafood brand Licious has acquired Bengaluru-based offline retailer My Chicken and More. My Chicken and More is known for its in-store experience. Between 2021 and 2023, the brand claims to have expanded from 10 to 23 outlets, generating revenues of Rs. 110 crore in 2023. With My Chicken and More’s 23 stores, Licious will expand its physical retail footprint to 26 points of sale.

Meanwhile, the operating revenues of Licious fell by 8% to Rs 685 crore in FY24 compared to the previous year, as per the company’s financials. The revenue drop resulted from weaker offline sales, which decreased from Rs 76 crore to Rs 36 crore.

House of brands, Evenflow has raised an undisclosed amount in a bridge round at more or less a similar valuation that it raised a round in 2021. The new funds will be used to expand operations and grow all seven acquired homegrown brands — Xtrim, Yogarise, Rusabl, BabyPro, Trendy Homes, Cinagro, and Frenchware. There’s even talk of an IPO in 2027.

Big Mama: D2C brand Mamaearth ranked as the 3rd largest skincare brand in India, as per Euromonitor International. The Gurugram-based company also rose to the 9th spot among India’s top beauty and personal care brands, up from 13th last year. Its second brand, The Derma Co., has entered the top 20 skincare brands in India, emerging as the largest active-based skincare brand in the country. Founded with its flagship brand Mamaearth, Honasa Consumer has expanded its portfolio to include various purpose-driven brands such as The Derma Co., Aqualogica, Dr. Sheth's, and BBlunt.

D2C footwear brand Yoho has raised INR 27 Cr to sell orthopaedic shoes. Founded in 2020 by Ahmad Hushsham and Prateek Singhal, Yoho manufactures affordable orthopaedic lightweight footwear using AI-powered solutions. The company plans to use the fresh capital to fuel its domestic and international expansion, scale up investments in research and development (R&D) and grow its product portfolio.

Brown Living, an Indian marketplace for sustainable and plastic-free products, offering a curated selection of eco-friendly goods across fashion, home decor, lifestyle and more has raised a funding round. The claims to have seen a phenomenal YOY growth of 500% since its first round of funding in June 2021.

Millet snack company Troo Good has raised $9 million in funding. Started in 2018 by Raju Bhupati, the Hyderabad-based company presently sells over 3 million units daily of its millet chikkis and other millet snacks. With the fresh capital, it aims to expand its market share in the healthy snacks segment.

Gut Health Time: Lifechart, a gut wellness brand, raised $500,000 in a seed funding round. Co-founded in 2022 by Mukul Shah and Mansi Sharma, Lifechart aims to tackle the increasing gut health issues in India by offering AI-driven predictive technology and products created by BAMS and BHMS doctors.

Mumbai-based direct-to-consumer (D2C) startup The Good Bug made gut a priority for VCs too by raising USD 3.5 million. Founded in 2022 by Keshav Biyani and Prabhu Karthikeyan, The Good Bug specialises in offering gut health and wellness products tailored to assist individuals dealing with lifestyle-related chronic issues, including bloating, constipation, and weight management.

📢Premiumization

The Ready-to-Eat Market is seeing a rapid change. A recently launched The World on Our Dining Table: A Report on How India Eats at Fi India 2024, offers insights into these shifting habits.

The traditional three-meals-a-day pattern is gradually being replaced by more frequent eating occasions as lifestyles, health awareness, and convenience reshape the way people eat. This shift in eating patterns is driven by several factors, including busier schedules, changing social habits, and a growing preference for healthier, smaller meals.

Snacks, once merely filler between main courses, are now replacing traditional meals in some instances. Many people are turning to quick bites like protein bars, yogurt, and even instant noodles as convenient mini-meals to satiate hunger during busy days.

The beverage market is also transforming, with an increasing demand for functional drinks that offer more than just hydration or flavor. Consumers now want beverages that provide health benefits, such as stress relief, enhanced hydration, or nutritional boosts.

More than 40% of consumers enjoy sweets or desserts at least two to three times a week. Western desserts are particularly favoured, with categories like cakes and pastries leading the charge.

According to the report, 60% of millennials and Gen Z consumers in metro cities are willing to pay up to 15% more for cleaner, healthier ready-to-eat and ready-to-cook (RTC) products. 30% of consumers are willing to pay more for snacks made from better-for-you ingredients or those that offer exotic flavours like Thai curry or khao suey.

📚Reads and Recommendations

Amazing Business Breakdowns podcast that goes in-depth into brands like Coupang, Lululemon and Ferrari. Also, check out their episodes on Shiprocket and Shopify.

Tiktok’s not in India but it plans to have a strong affiliate game. Creators only need around 1,000 followers to earn commissions selling noodles, toys, and Christmas trees.

Zara's website is a confounding headache — but it's also the secret to its success. A quick Google search will yield blogs complaining that the website is "virtually unusable" despite being "visually appealing." Reddit threads calling it "impossible" to navigate, and links to YouTube videos about how "annoying" it is. Experts say the layout is part of a master plan to project a more upscale image and distance Zara from other fast-fashion rivals such as H&M or Shein.

Spice up your “About Us” Page. Here are some ideas.

Sometimes, to stand out, you must break out of the two-dimensional box that advertisements typically inhabit.

That’s all for this week! Bye!

Stay tuned for more.

Liked this week’s issue? Share it with your pals.