☕Mocha Mousse in D2C

Intellectual Obesity, Dark Store Tally, Consumer Funds, Urban India Woes, GenAI Use Cases

Hi Surgies 👋

The Black Friday Sale was a surprise for online sellers. With comments like “Looks like the BF Sale will be a focussed event from the next year”, “We didn’t expect these kinda numbers” from D2C brand founders, it seems like this is going to be a part of the yearly sale calendar. Direct-to-consumer brands and ecommerce marketplaces saw a 17-18% rise in Black Friday order volumes compared to last year.

Beauty, wellness, and personal care products posted growth of over 34% in order volumes compared with last year

Health and pharma saw more than 50% growth in volumes

Fashion and accessories recorded a more than 20% year-on-year (YoY) increase in volumes

Home decor segment saw over 40% YoY growth by volume

🗞️Marketplace Buzz

Qcom’s Fashion Sense. Myntra has announced the launch of ‘M-Now’, enabling shoppers to receive their orders in about 30 minutes. This quick-commerce offering will be initially available in Bengaluru and will be expanded to more cities later. With the incumbents ( aka Blinkit, Zepto) having launched the fashion category it was a matter of time before Myntra jumped into the ring.

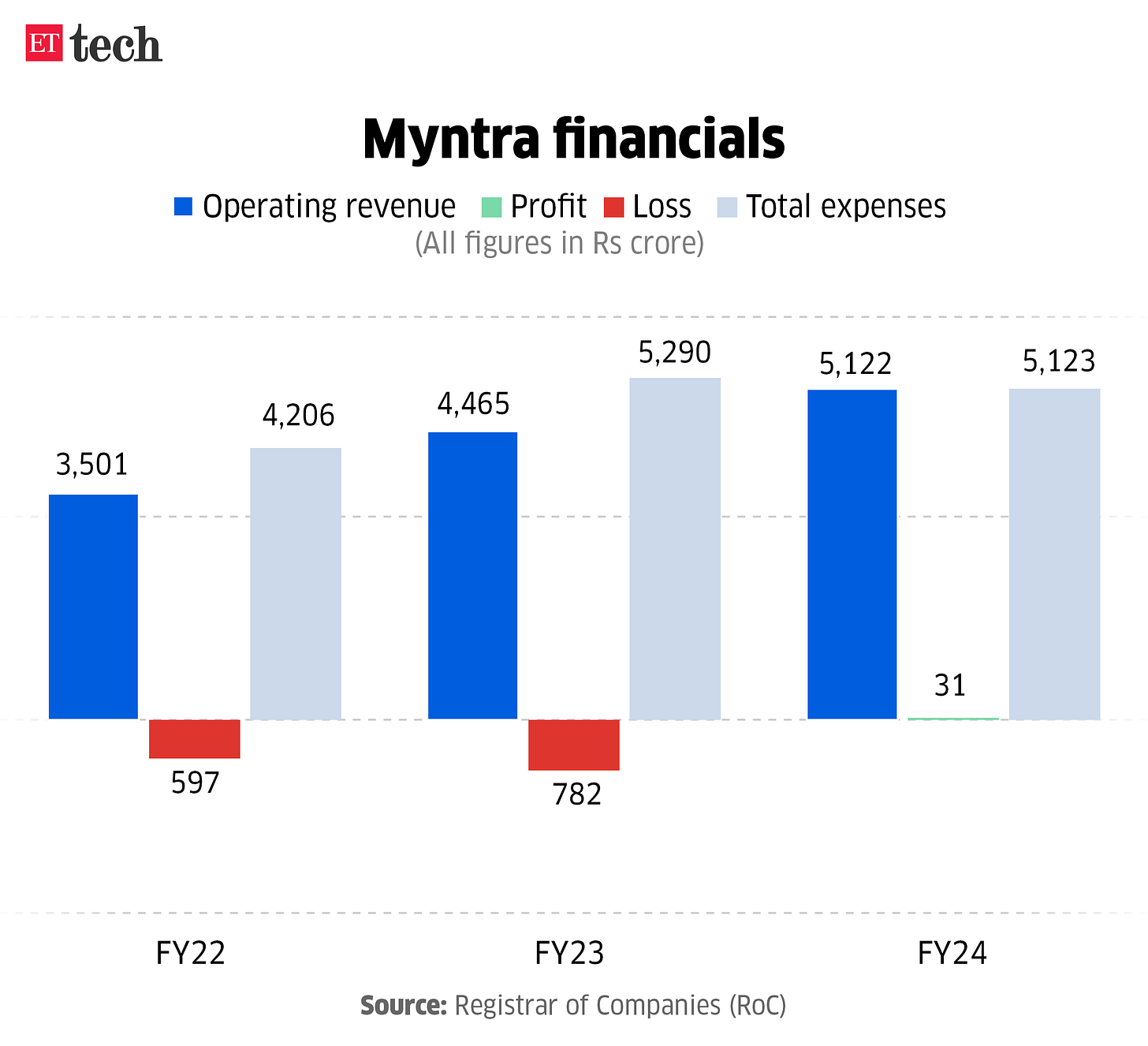

Meanwhile, there’s been a turnaround: The company swung to profit in FY24, and revenue jumped 15% to Rs 5,122 crore.

Meesho’s H1 FY25 sales top $1.7 bn, net losses shrink to $5 mn. This reflects a 29% increase compared to the year-ago period. The ecommerce company is now in a stronger position compared to the two-year period from 2021 to 2023, during which it burned through $250-300 million annually while expanding aggressively.

The curious case of Cred Coins. Looks like there is some use for them in the future. Cred is piloting a new feature which allows app users to use Cred Coins at offline and online stores. For instance, a Cred member will be able to use coins at food and beverage outlets after scanning a QR at the merchant outlet. The pilot is currently live for a few selected users.

Foodtech and quick commerce giant Swiggy has driven a 30.3% quarter-on-quarter growth in its operating revenue which spiked to Rs 3,601 crore during Q2 FY25 compared to Rs 2,763 crore Q2 FY24. The company’s quick commerce segment also saw remarkable growth, with revenue surging by 135% to Rs 490 crore in Q2 FY25 from Rs 208 crore in Q2 FY24.

Data Check: Quick Commerce Dark Store Tally

Swiggy: added 86 dark stores in H1-FY25 | Cumulative count: 609

Blinkit: added 265 dark stores in H1-FY25 | Cumulative count: 791

Zepto’s had a tough week with a report on dark patterns in the app and work culture concerns. Fresh out of bumper USD 350 million funding, this time from marquee domestic investors, the quick commerce company says it is on a clear path to becoming a full Indian-owned entity, hitting PAT positive milestone and a possible IPO in 2025.

💸Consumer Focused Funds

An attempt at a list of funds focused on brands, marketplaces and enablers in the e-commerce ecosystem. A few got missed out, check out the comments here.

🍕D2C Snippets

Furniture and home decor brand Wooden Street raised Rs 354 crore in funding. Notably, this is one of the largest capital raises in the home and furniture sector in recent years. Founded in 2015 by Lokendra Ranawat, Virendra Ranawat, Dinesh Pratap Singh, and Vikas Baheti, Wooden Street has emerged as a household name in India’s furniture 🛋️market. The company claims to have 102 experience stores, 20+ warehouses, and a 15 lakh sq ft manufacturing facility spread across the country.

Protein Power: Ranveer Singh's SuperYou raised an undisclosed amount in funding. SuperYou recently launched India’s first Protein Wafer Bars 🍫, a product designed to cater to the growing demand for nutritious yet convenient food options. The startup sold around 2.5 lakh units within 48 hours of its launch. Co-founded by Ranveer Singh and entrepreneur Nikunj Biyani, SuperYou plans to invest Rs 40-50 crore in its operations and aims for Rs 500 crore in revenue over the next five years.

Shape Up: Terractive, a Mumbai-based lifestyle activewear brand has raised Rs 8 crores in a Pre-Series A funding round. Founded in 2023 by sisters Raena Ambani and Rahee Ambani-Choksi, Terractive redefines activewear🏃♀️ by blending innovative fabric technology. The company plans to utilize the funds to accelerate fabric development and enhance product innovation.

HUL just revealed its premiumisation gambit; D2C brands beware. The FMCG giant is eyeing massive premiumisation 🏍️ across various categories with some of its flagship brands. HUL has "all the resources to disrupt these spaces, and it's not a pleasant sight for these smaller D2C brands" as per an Industry expert.

What’s Cooking🍳: D2C kitchenware startup The Indus Valley has raised Rs 23.1 crore in its pre-Series A round. The Indus Valley specializes in toxin-free kitchenware, offering safe alternatives to chemically coated products. Its products are made from cast iron, iron, copper, clay, and wood.

No Junk🍟: Shilpa Shetty-backed WickedGud, a food products brand, has raised Rs 20 crore. Co-founded in 2021 by Bhuman Dani, WickedGud is a D2C startup dedicated to unjunking India one kitchen at a time with a variety of healthy and indulgent food products.

📢Leader Speak

“Difficult to comment on quick commerce market share when competitor’s information is picky” - Sriharsha Majety, CEO and Co-founder, Swiggy

📈Trend Spotting

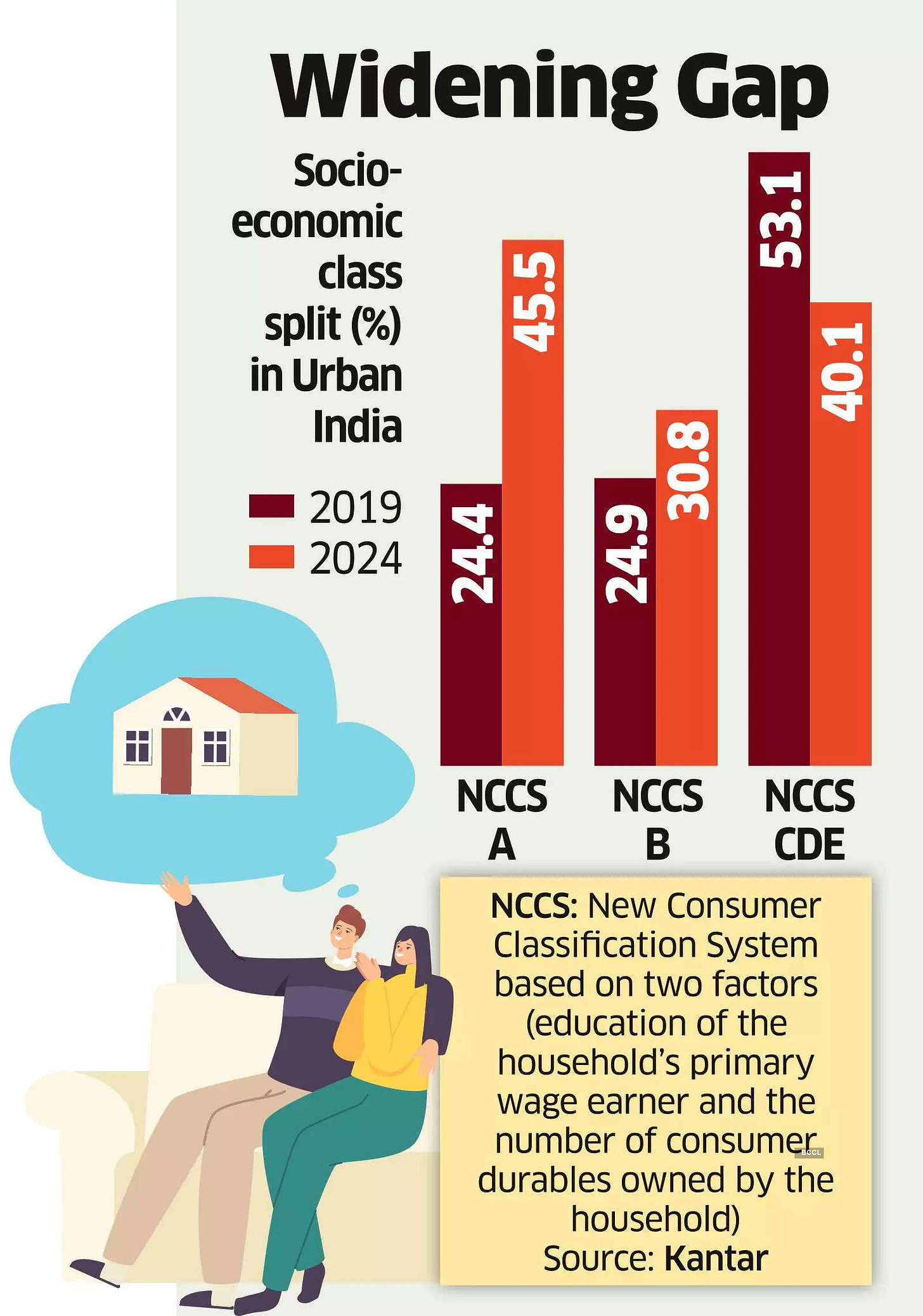

Marketing data and analytics company, Kantar, released its "India at Crossroads" report, analysing the future of marketing in India for 2025. Key trends include socio-economic shifts, positive rural sentiment, aspiration-driven premiumisation, evolving media consumption, understanding Gen Z, and future scenarios for 2025. TLDR:

The urban middle class 👩👩👧, a key consumer group, has shrunk, and real incomes are under pressure, impacting consumer confidence. Urban consumption has slowed more than rural consumption.

Premiumisation 🚘will grow. Despite economic pressures, aspiration remains a driving force in consumer behaviour. Smaller families, women focusing on self-care, and Gen Z’s pursuit of individual identity all contribute to this trend.

Storytelling 🖊️continues to be essential for connecting with consumers, though the storytelling methods may evolve. The emotional connection remains crucial.

Plenty of suggestions for media planning, communicating with GenZ and balancing influencer content with linear TV.

🚩Infographica

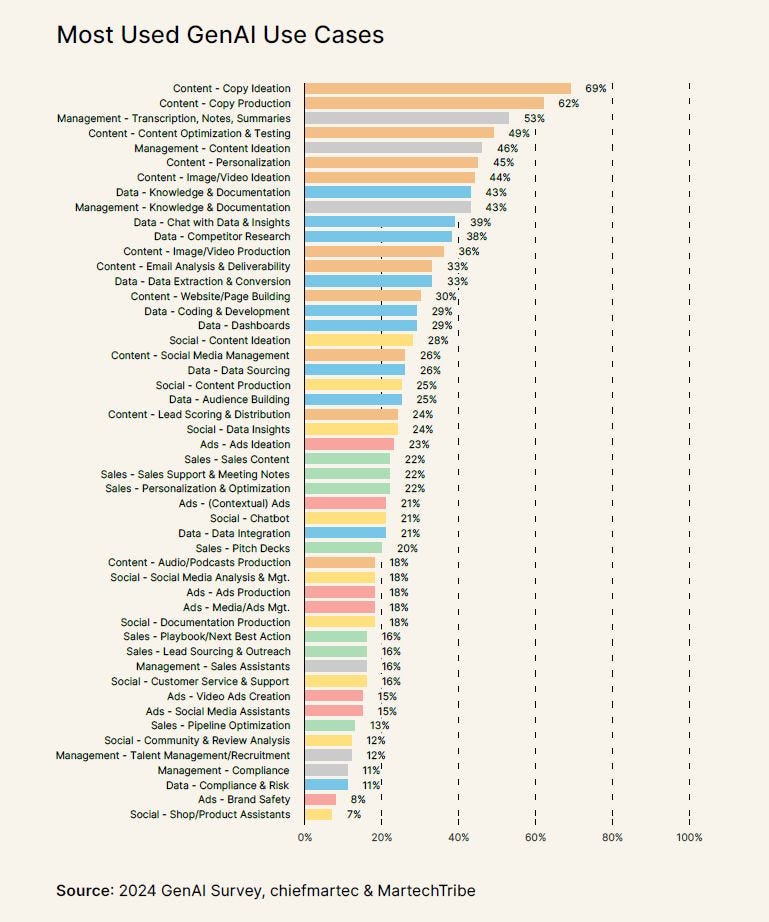

Generative AI is transforming the martech industry.

📚Reads and Recommendations

The FMCG - General Trade landscape is changing. For years, FMCG has been the pride of sales professionals, offering structured career paths and the satisfaction of building trust with distributors and retailers. But the traditional narrative of “owning the beat” and managing relationships is now under pressure from disruptive forces.

The socio-economic gap is widening in urban India. Affluent households surged by 86% in 2024 compared to 2019, while lower-middle-class households declined by 25%.

The Pantone Color Institute announced Mocha Mousse as its 2025 Color of the Year, described by the company as “an evocative soft brown that transports our senses into the pleasure and deliciousness it inspires.” Awaiting D2C Launches with this color.

Amazon DSP vs Amazon Sponsored Display. What to use when.

In an age of information overabundance, our curiosity, which once focused us, now distracts us. And it’s led to an epidemic of intellectual obesity that’s clogging our minds with malignant junk.

That’s all for this week! Bye!

Folks at some companies have told us this newsletter is almost mandatory weekly reading for their teams 🥰. If your company is not in on it yet, get your teams on the latest in the e-commerce space every week.

Stay tuned for more.

Liked this week’s issue? Share it with your pals.