🔥Regulator's Fire in Marketplaces

Blemishing Effect, Amazon's Numbers, EV Armada, Flat Sound, Green Shoots

Hi Surgies 👋

A warm welcome to the folks at London Business School who signed up in droves. It’s been a super busy week with the financial reports pouring in, the regulator pushing its weight and the funding news. Lets dive in…

🗞️Marketplace Buzz

Amazon Seller Services, which operates the marketplace business of Amazon India, saw its revenue jump 14.4% to cross the INR 25,000 Cr mark during the financial year ended March 31, 2024.

The company also reduced its net loss by 28% during the year to Rs 3,469 crore.

Amazon’s advertising revenues grew by 24% to Rs 6,649 crore

Revenues from third-party merchants climbed by 14% to Rs 14,285 crore during the year, slower than 33% for FY23. This accounted for 56% of Amazon India’s e-commerce income.

Meanwhile, Flipkart’s marketplace unit reported a 21% increase in operating revenues and a 50% increase in advertising revenue to Rs 4,792 crore.

Here’s what India’s contribution looks like overall (2023)

EV Armada: Flipkart is integrating EVs in its delivery fleet phase-wise as it aims to fully electrify its delivery fleet by 2030. The company’s delivery fleet now comprises of 10K EVs. 🌴💗

Regulator’s Fire: It’s been a busy month for the government agencies on the marketplace front.

India's financial crime agency, the ED, is turning up the heat on e-commerce giants Flipkart and Amazon. The ED seems to be looking closer at how these e-commerce firms handle their inventory, specifically whether they're playing by the rules of the Foreign Exchange Management Act (FEMA) and India's e-commerce regulations.

Meanwhile, a Competition Commission of India (CCI) investigation, initiated after a complaint by the National Restaurant Association of India (NRAI), alleged that the food delivery platforms' practices favoured select restaurants. Zomato clarified that the CCI's 2022 inquiry, prompted by concerns over listing preferences and pricing parity, has not yet yielded any formal conclusions. Swiggy also dismissed the report as misleading.

Semi-urban commerce platform Wheelocity has raised $15 million in an extended Series A funding round. Founded by Selvam VMS and Senthil Kumar in September 2021, Wheelocity aims to bridge the commerce access gap across India’s semi-urban and rural markets, where over 800 million people remain largely underserved by existing commerce platforms. Wheelocity has built a platform that delivers high-frequency direct access infrastructure, beginning with essential goods (fresh and grocery) as a foundation for expansion into discretionary categories.

Unicommerce to take on Shiprocket with the acquisition of Shipway. Shipway managed significant growth in the past few years and now expanded its horizon with Shipway Xperience and SMS-WhatsApp marketing tool The Convert Way. The acquisition will enable Unicommerce to cross-sell courier aggregation and shipping automation services to its 4,000 clients. At the same time, Unicommerce will have a new set of clients from Shipway’s 3,000 partners.

Dealshare FY24 revenue falls 75% post-restructuring, loss narrows to a third. The company’s gross revenue from operations fell to Rs 499 crore in FY24 from Rs 1,963 crore in FY23. Dealshare had pivoted to a consumer-centric model, selling groceries through an app and offline, with a focus on opening mini-mart stores in north India.

Nykaa revenue grows 24.4% YoY to Rs 1,874 Cr in Q2 FY25. The GMV for the beauty segment rose 29% YoY to Rs 2,783 crore in the second quarter. The same for the fashion business increased 10% YoY to Rs 863 crore. The Superstore by Nykaa saw 80% YoY growth in the GMV during the second quarter with cumulative transacting retailers growing 60% over the last-year.

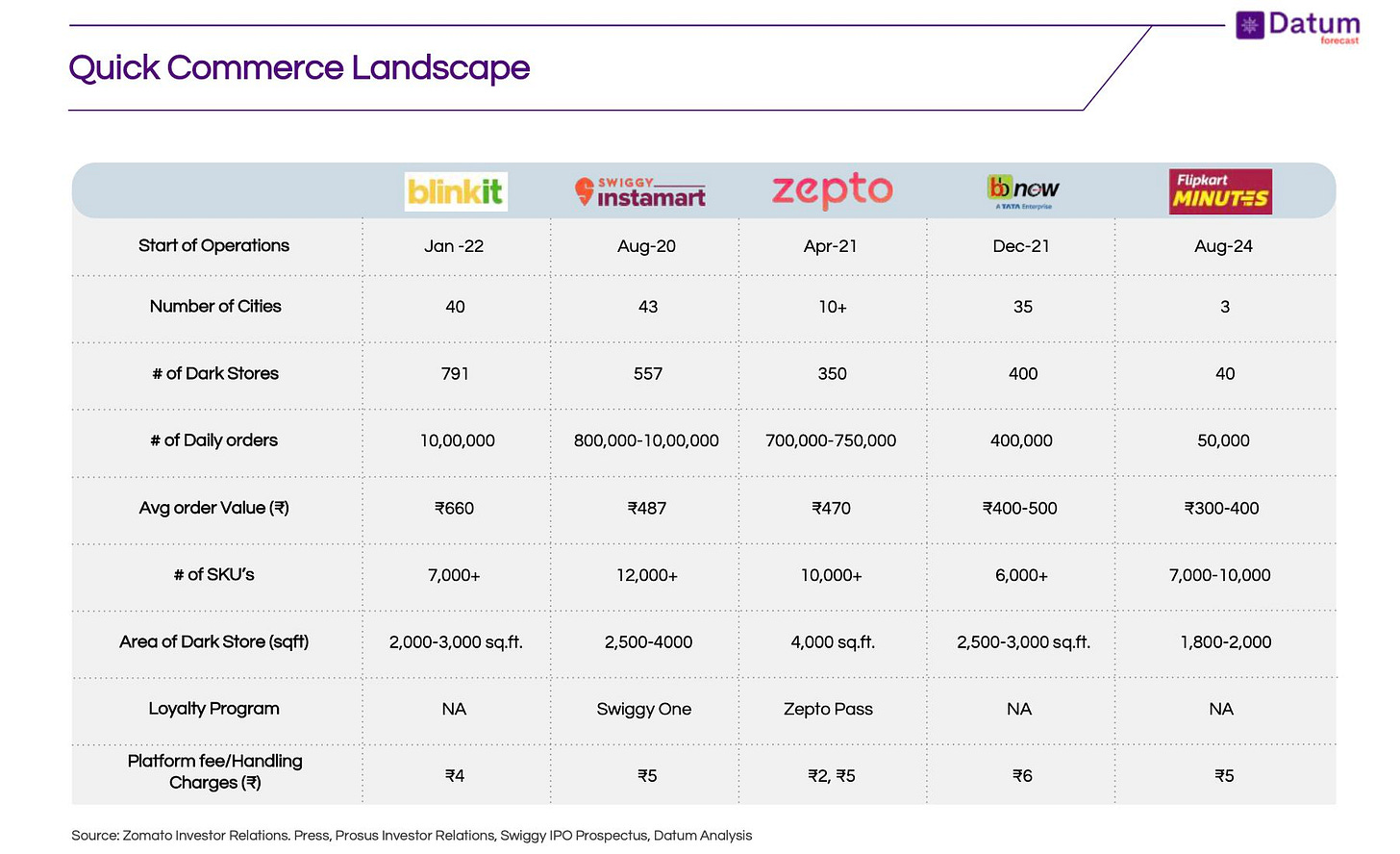

Quick commerce ready reckoner

and a Quick Commerce Jai-Veeru Moment during the Swiggy Listing

🍕D2C Snippets

Green Shoots: Gardening startup Ugaoo secures Rs 47 cr in Series A funding round, plans to open 80 retail stores by 2030. Currently, the company has over 1,500 SKUs across various categories including live plants, vegetable and flower seeds, soils and fertilisers, gardening tools and accessories, along with sustainable gifting options. It aims to scale production to 5 lakh plants each month.

Retail Woes: Honasa Consumer Ltd-Mamearth’s parent company’s revenue from operations decreased 6.9% to Rs 462 crore in Q2 FY25 from Rs 496 crore in Q2 FY24. The company posted a net loss of Rs 19 crore for July–September 2024 compared to a net profit of Rs 30 crore in the same quarter last year. The impact of product returns and inventory corrections had been greater than anticipated as per the founder. In addition to Mamaearth, Honasa owns The Derma Co, Aqualogica, Ayuga, BBlunt, Staze 9to9 and Dr Sheth’s. Mamaearth has had a significant offline presence. However, its strategy to expand the footprint using super stockists ran into trouble, and it is now switching to direct distributors in the top 50 cities in India

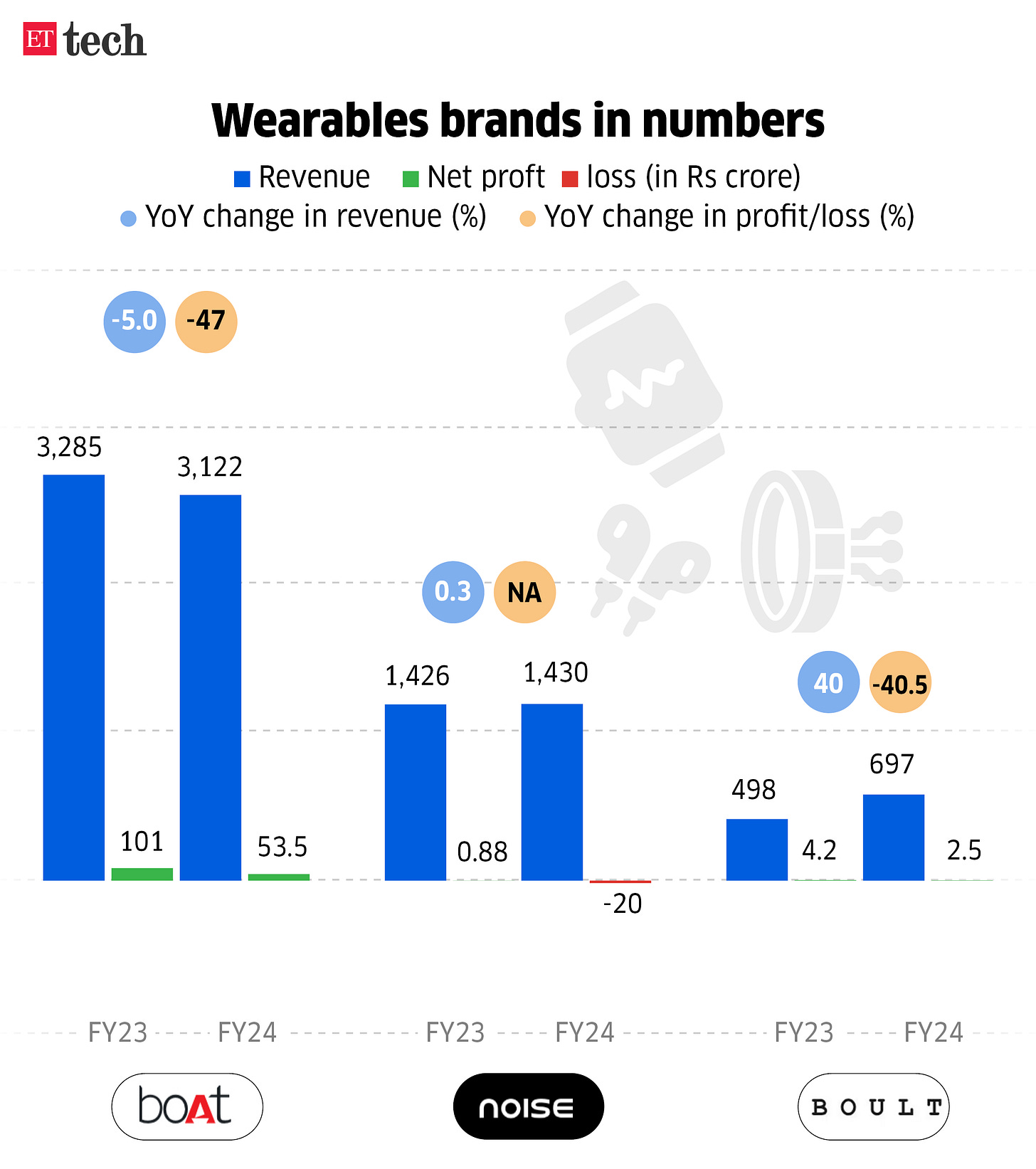

Flat Sound: Bose-backed gadget and wearables brand Noise posted an operating revenue of Rs 1,430.8 crore in FY24, marginally higher than Rs 1,426.4 crore that it clocked a year ago. The Gurugram-based company reported a net loss of Rs 20 crore in the year ended March, compared to net profit of Rs 88 lakh in FY23. The continued consumption slump in wearable devices such as earphones and smartwatches for the last 12-15 months, impacted all companies.

Globalbees reported a 55% year-on-year revenue growth with Rs 432.5 crore in the July-September quarter. The company’s EBIDTA also surged by 154% year-on-year and continues to be a growth engine for its parent company Firstcry.

Mild Coffee: Personal care and beauty brand mCaffeine’s revenue declines to Rs 193 Cr in FY24 from Rs 205.3 crore in FY23. The dip in sales in FY24 comes as a surprise, as the firm’s co-founder and chief executive, Tarun Sharma, had claimed that mCaffeine would achieve a 50% increase in sales during the last fiscal, with profitability in sight for FY25. the beauty and personal care sector has been facing a revenue decline across brands (though there are a few bright sparks).

📢Power Talk

"The reality is that quick commerce is impacting kirana (stores). The reality is that its impact on e-commerce is not as large as its impact is broadly on the larger retail ecosystem." - Sahil Barua, Co-founder, Delhivery

📚Reads and Recommendations

Chinese immigrants in America are offering their living rooms and garages as warehouses to cross-border sellers on Temu, TikTok, and Amazon. The mini fulfilment centers help deliver orders, examine returns, and sell excess inventory to local stores.

Here’s an interesting take on the e-commerce wars across India, USA, SEA

The tough life of a VC. Check out the Omega Files- Episode 2 by the good folks at Blume. A ton of insights in the long read.

The Psychology of the Blemishing Effect. Mentioning a slightly negative feature, such as limited colour choice, after highlighting the positive features can increase sales compared to *only* mentioning positive features. Here are some examples.

Have you seen online sales spike when your brand opens an offline store? ( I can see you nod a yes with my email eyes ) Check out how Nespresso measures the online impact of its boutiques.

That’s all for this week! Bye!

Folks at some companies have told us this newsletter is almost mandatory weekly reading for their teams 🥰. If your company is not in on it yet, get your teams on the latest in the ecommerce space every week.

Stay tuned for more.

Liked this week’s issue? Share it with your pals.