🐶 Your next colleague might be a Beagle. First, it was fluff. Then it was therapy. Then the content. Dogs aren’t just mascots, they’re mood boards, marketers, and apparently, CXOs.

ASICS just hired a fluffy influencer to front its wellness campaign. A Hyderabad startup gave its golden retriever a legit job title. Emotional ROI is the new KPI. Brands chasing relevance? Better start with a wag, not a wireframe. While Denver and Felix fetch headlines, here’s what the rest of the D2C kennel’s been up to👇🏼

🗞️ Marketplace Buzz

Myntra just got a ₹1,063 Cr shot from its Singapore parent, timed suspiciously close to its Singapore launch and Flipkart’s India-domicile move. This isn’t just about fuelling fashion growth; it’s dry powder for global sandbox testing, cross-border ops, and maybe even float prep. Myntra’s not just Flipkart’s fashion arm anymore, it’s starting to look like the IPO’s flex arm.

Flipkart’s growth looks great, if you squint past the burn. 20–25% order growth and yet Flipkart’s not coasting; it’s cranking up fashion, q-comm, and AI to hit 30% by June. Myntra’s pulling in 40% of new users, and Flipkart Minutes is gunning for 800 dark stores (does real estate cost get added to CAC in qcomm world?). Add a 6x AI spend and the Singapore-to-India flip, and it’s clear: this isn’t growth alone, it’s groundwork for an IPO.

FirstCry’s growing…₹1,930 Cr in Q4FY25 revenue (+16% YoY) looks solid, until you see the ₹111 Cr net loss which is 2.5x last year. Offline stalled, sequential sales dipped, and store issues didn’t help. This is

lookingsounding like a colicky baby: loud, messy, and in need of a reset. Markets slapped back with a 6% drop. Growth is cute, but margin’s still missing.

The glam isn’t just in the topline. Nykaa posted ₹7,950 Cr in FY25 revenue (QoQ 24% jump), and the shift in perception is worth clocking. What started as a beauty play is now fashion, personal care, and marketplace infra bundled into a brand-led engine. Growth is steady, but the real battle is category dominance without margin erosion. Nykaa’s moat? Deep content, loyal cohort, and first-mover platform advantage. Its been a roller coaster ride for eh marketplace since its listed

Impulse fashion is booming on Zepto and Blinkit- ₹400–700 carts for sangeet SOS and haldi emergencies. But here's the kicker: while brands like Enamor and Libas are tailoring SKUs for 10-min delivery, the logistics bill and CAC are brutal. Returns are lower than Myntra, but the unit economics still suck.

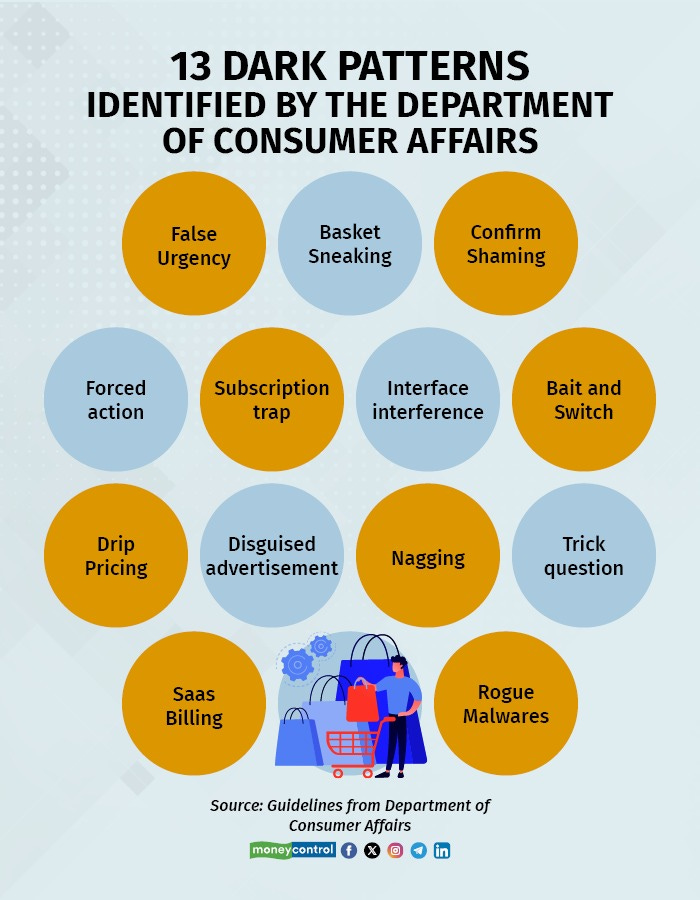

The Indian government’s done being subtle; ecom platforms have been told to kill dark patterns yesterday. From fake countdowns to pre-ticked boxes, Consumer Affairs Minister Pralhad Joshi isn’t buying your “growth hacks.” Brands are now expected to run audits or get slammed by the CCPA. The line is clear: if your funnel feels like a scam, you’re one notice away from a fine.

TOGETHER WITH EZYLEGAL

Talking of government, when you finally launch your D2C brand, the govt is gonna ask, “Nice. Now, where’s your GST?”

You’ve got 237 problems, and GST better not be one. Between chasing Meta ROAS and wrangling supplier drama, the last thing you need is deciphering Kafka-level tax code.

Enter Ezylegal. They’ll register your company for GST faster than your supplier says “payment advance milega?” No jargon. No back-and-forth with CAs. Just smooth, startup-friendly service that gets the job done while you focus on scaling.

Use coupon code SURGE10 to get a 10% discount on GST filing because “non-compliant” isn’t the look your P&L needs.

🍕 D2C Snippets

Revant Himatsingka, aka the FoodPharmer, the watchdog who called out sugar bombs and “junk health”, is turning his 1 M+ food-curious following into a business. FoodPharmer 2.0 will launch its own FMCG line, starting with “clean-label” products certified through its new badge. It's a masterclass in flipping trust into transaction.

Snitch bags ₹280 Cr and wants to stitch a ₹1,000 Cr story. But this isn’t just about hype fits and Gen Z drip. With FY24 revenue at ₹241 Cr and actual profit in the bag, this D2C beast wants to 4x by FY26, increase store count, and IPO in 3 years. This looks to be a scaled engine for trend-chasing bros who don’t want to pay Zara prices. The real challenge? Staying cool while growing up.

Luggage brand Eume zipped up ₹25 Cr from early-stage backers to chase GenZ’s airport-core fantasy-USB-charging, anti-theft, minimal flex. But this is a category where features are table stakes. With Mokobara already owning the mind space, Eume’s challenge is clear: build faster, sharper, and turn baggage into a badge.

Home hygiene brand Cleevo just mopped up $1M. Their pitch? Concentrate-based floor cleaners that slash plastic, cut emissions, and still leave your tiles shining. It’s not just cleaner cleaning, it’s a climate flex in a mop bottle. Next stop: 10x manufacturing, global shelves, and a D2C brand that turns scrubbing floors into a badge of eco-honour.

Shraddha Kapoor-backed Palmonas is locking in ₹55 Cr from Vertex Ventures. FY24 revenue? ₹5.38 Cr. Loss? ₹1.24 Cr. That’s the hallmark right now. But with SS + 18k gold designs, Palmonas is betting that demi-fine jewellery can do what most fashion jewellery startups can’t: blend affordability, aspiration, and repeatability. It's not just selling sparkle, it’s testing if India's mass-premium fashion playbook has room for long-term shine.

Bolas is gunning for a ₹900 Cr round from WestBridge & Co. to go from Karnataka's cashew king to national snacking overlord. Plan: scale from 80 to 200 stores and own the “healthy indulgence” lane by FY30. But here’s the plot twist: legacy B2B meets D2C glitz isn’t a plug-n-play. Bolas has the margins, but does it have the crunch to crack this nut?

Slikk isn’t building another fast fashion brand, it’s building infrastructure for delivering fashion. With $10M from Nexus and Peak XV’s Surge, this “try before you buy” platform is solving for reverse logistics, product fit, and doorstep curation in Tier 1+2. If Slikk can turn its promise of low-return, high-retention delivery into a plug-and-play layer for brands, it might just become the Shopify of apparel experience.

📚 Reads & Recos

Vertical Q-comm isn’t a side hustle, it’s a thesis. Mayank Jain breaks it down: high purchase frequency + strong immediacy = fit. Horizontal players fumble on long-tail SKUs, and dark store economics don't bend unless AOV, GM%, and delivery cost are tightly choreographed. This is no speed race, it’s a category calculus.

Apple just did what Apple does — topped Kantar’s BrandZ ranking again for the 4th straight year. Brand value? A casual $1.3 trillion. Yes, with a T. That’s a 28% jump from last year — not bad for a company that sells $1,000 phones and still gets us to queue like it’s a concert.

Ever wanted to get your product team to

copy, get inspired by a competitor’s product page? The most difficult thing ha been trying to explain the ‘exact thing’ you want. Give web annotation a try.Meanwhile in China. Alibaba announced that its new Taobao Instant Commerce portal has surpassed 40 million daily orders within a month of launch. The portal brings merchants from Alibaba's food delivery arm Ele.me onto its main domestic shopping app which promises to deliver items within 60 minutes

That’s all for this week! Bye!

PS: This newsletter's been making the rounds in growth teams, brand meetings, and even investor decks (true story). If your company is not in on it yet, get your teams on the latest in the e-commerce space every week. They'll thank you later 🙌