Hi Surgies 👋

Diwali is around the corner and many marketplaces and brands are kinda calling it an easy week (with work-from-home or taking the week off). Meanwhile, there’s never a dull moment in the online sphere.

Quick Commerce is Cleaning up Categories

Soapy Bubbles Episode

Some key insights from September 2024 on Blinkit by our friends at 1DS:

Body Wash:Soap Bar sales are almost 50:50 on Blinkit vs. 10:90 in offline sales.

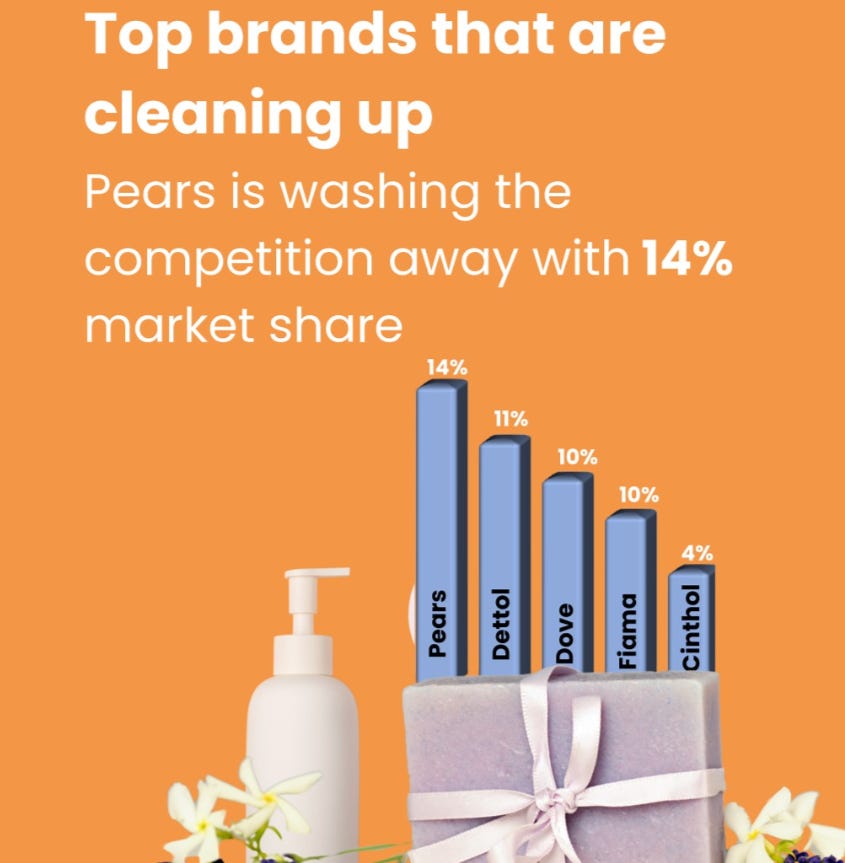

Legacy brands still rule with Pears being the clear winner, followed by Dettol, Dove and FiamaAverage spend on soaps is Rs. 170, while for body washes it is Rs. 230 New D2C brands are making a good dent in body washes - specifically BeBodyWise and ChemistAtPlay

There is clear regional divergence - Mysore sandal soap is strong in the South, Pears in the West and Dettol in the North

Total category sales of ~INR 8.8 cr/ month. Soap bars being ~INR 5cr and Body Wash ~INR 3.8cr

🗞️Marketplace Buzz

Flatish Year: After experiencing 82.6% growth in FY23, B2B e-commerce platform Moglix has registered a modest 5.5% increase in revenue during FY24. The sale of traded goods accounted for 98.98% of Moglix's operating revenue (which grew by 5.4% to Rs 4,914 crore in FY24). The growth slowdown is worrying, though the losses were trimmed by 16% during the same period.

Quick Comm 🤝EMI: With Blinkit ramping up on listing appliances and air purifiers flying off its (dark store) shelves it was only a matter of time before the company launched an EMI option for its customers, allowing them to split payments for purchases over Rs 2,999. An EMI option, through third-party lenders (Blinkit tied up with several banks such as HDFC, SBI, ICICI, Kotak Mahindra, Axis, RBL and CITI Bank to provide EMI options via credit cards), is one more way to eke out margins in the tough e-commerce business.

Pill Run: Swiggy Instamart looks to strengthen its pharmacy play with Pharmeasy for 10-minute medicine deliveries. Swiggy is initially piloting this offering in Bengaluru where it will deliver medicines like pain relievers, fever medicines as well as medicines that require a valid prescription. Since the Bengaluru-based firm is partnering with the e-pharmacy company it does not require additional regulatory permissions for this foray.

B2B is Back: B2B commerce platform Udaan is looking to raise $80-100 million from existing backers. In 2023, Udaan’s valuation fell to $1.8 billion from $3.2 billion in 2020, which resulted in dilution for stakeholders. Udaan’s net merchandise value run-rate is hovering around $600-700 million. Founded in 2016 by former Flipkart executives Vaibhav Gupta, Amod Malviya, and Sujeet Kumar, Udaan is an online B2B marketplace offering multi-category products. It enables retailers and businesses to discover and buy groceries, baby care products, hardware tools, sports equipment, electronics, clothing, fashion accessories, home furnishing products, medicines, and more.

Tractor-focused marketplace Tractor Junction has been growing rapidly, with the company’s operating revenue surpassing the Rs 60 crore mark for the fiscal year ending March 2024. Tractor Junction’s operating revenue surged 2.3X to Rs 62 crore in FY24 from Rs 26.8 crore in FY23. Tractor Junction is a rural vehicle marketplace facilitating buying, selling, financing, and insuring new and used tractors, farm equipment, and rural commercial vehicles. It also provides essential information and vetted reviews on farm machinery, enabling users to compare options.

Amazon in the USA is terminating some wholesale vendor accounts, leaving affected brands anxious ahead of the holidays. The brands affected appear to be part of Amazon’s 1P invite-only program. Any change of plans for Amazon India 1P?

🍕D2C Snippets

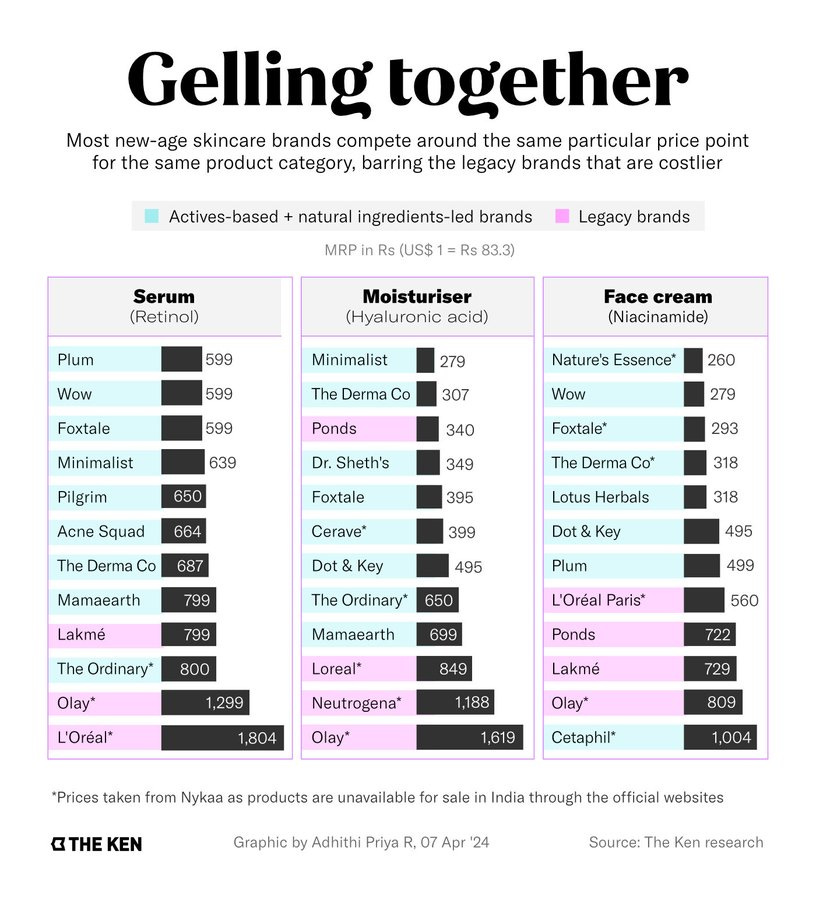

Active Skincare: The pandemic saw D2C brands like Minimalist emphasise active ingredients in skincare. This transparency led consumers to shift to actives-based skincare products. The shifting consumer preference from natural ingredients like aloe vera and turmeric to active ones like retinol and ascorbic acid (Vitamin C) in skincare and the success that brands like Minimalist have seen in India have prompted legacy players to adapt to the market trends.

Fashion and lifestyle brand Zouk has raised $10 million in a funding round. The brand currently has four exclusive brand outlets and is targeting a total of 75 outlets in the next two to three years. Founded in 2016 by Disha Singh and Pradeep Krishnakumar, the Mumbai-based brand offers bags, wallets, and footwear. The company is known for making Peta-approved bags and other products using “vegan leather”. In the online space, the company sells its products through its D2C website, marketplaces as well as quick commerce. India’s online lifestyle market is set to reach $40-45 billion by 2028, compared to its current size of $16-17 billion, according to a joint report by management consulting firm Bain & Company and fashion marketplace Myntra.

📢Power Talk

"The scale of operation is changing as the industry is growing larger, both for beauty and fashion and you'll see that most successful models will have an omnichannel approach to serving consumers where they are." - Falguni Nayar, Founder and CEO, Nykaa

📷Click Pic

Sensor Tower data on grocery app MAUs

📚Reads and Recommendations

Moment Marketing: Very soon (probably around December 4th)—the internet will explode with one thing: “Spotify Wrapped 2024”. Here’s the step-by-step playbook to hijack Spotify Wrapped.

Amazon just released its A+ Content Generative AI Guide. Mansour Norouzi has wrapped it up in a cool presentation. Here it is.

Learnt a new word: Meta released a Restaurant Summit 2024 report that revealed “Webrooming,” or researching online before buying in person, has risen 1.95x over the last four years.

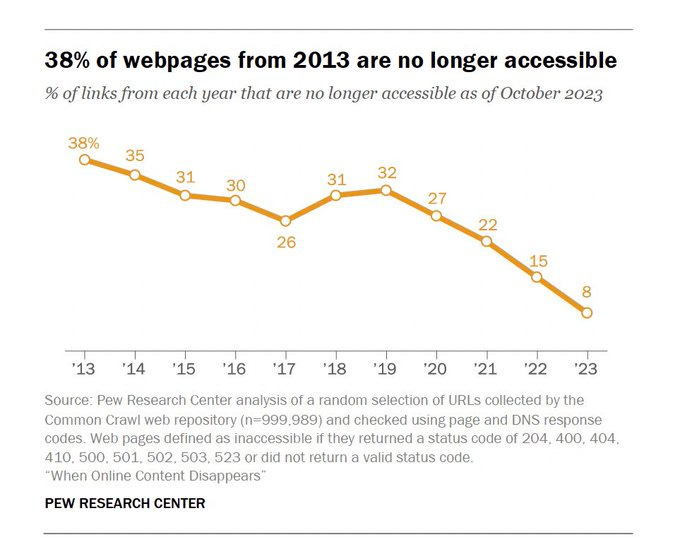

The half-life of knowledge is the time it takes for new knowledge to either be lost or obsolete. The half-life of knowledge is now probably closer to a year, maybe less.

How Saree brands get their names from Rasgulla to Baramulla! In an effort to capture the attention of Gen X, one trader launched a brand with an unusual name, "Oxford," which has now been in the market for 21 years and has frequently made headlines.

Folks at some companies have told us this newsletter is mandatory weekly reading for their teams 🥰. If your company is not in on it yet, get your teams on the latest in the e-commerce space every week.

That’s all for this week! Bye!

Stay tuned for more.

Liked this week’s issue? Share it with your pals.