🎁Tales of Shein, Gift Cards and VCs

Decathalon's marketplace, Zuck's brand, Zepto's user acquisition

Hi Surgies 👋

The rains parted Delhi's pollution fog momentarily, enabling a glimpse at the blue skies. Christmas decorations dot the streets and malls. There is much to cheer about in the capital city, like the electronics and appliances companies that are seeing a shift in consumer buying behaviour. Online channels accounted for 34% of the consumer electronics sales in the country this year, up from 32% in 2023. More cheer for the quick commerce folks who are fast expanding into electronics and durables.

🗞️Marketplace Buzz

Fit to Sell: There’s a new marketplace in town (sort of). Decathlon India has begun listing rival brands like Adidas and Garmin on its website, redirecting customers to the brands' sites for purchase. This online marketplace approach aligns with Indian FDI regulations, while in-store sales remain limited to Decathlon's own brands. Online sales contribute 15-20% of Decathlon India's ₹4,500 crore annual revenue. Globally, rival brands account for a fifth of Decathlon's revenue but in India, everything from running shoes to mountaineering equipment is sold under its own labels, in line with the local rules.

Return of the Dragon: Chinese fast-fashion giant Shein is returning to India through a partnership with Reliance Retail, following a 2020 ban. Shein will operate solely as a technology provider, while Reliance Retail maintains full ownership and control of the platform, including all data collected from Indian customers.

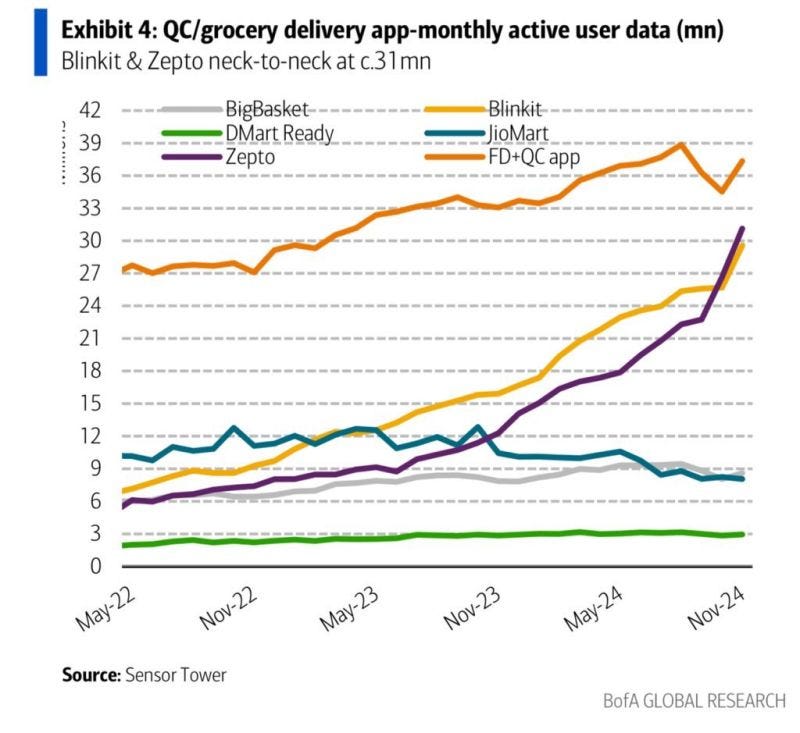

Zepto has been on a user acquisition spree, offering free cash, gifts, and discounts. Recently, it surpassed Blinkit in active users.

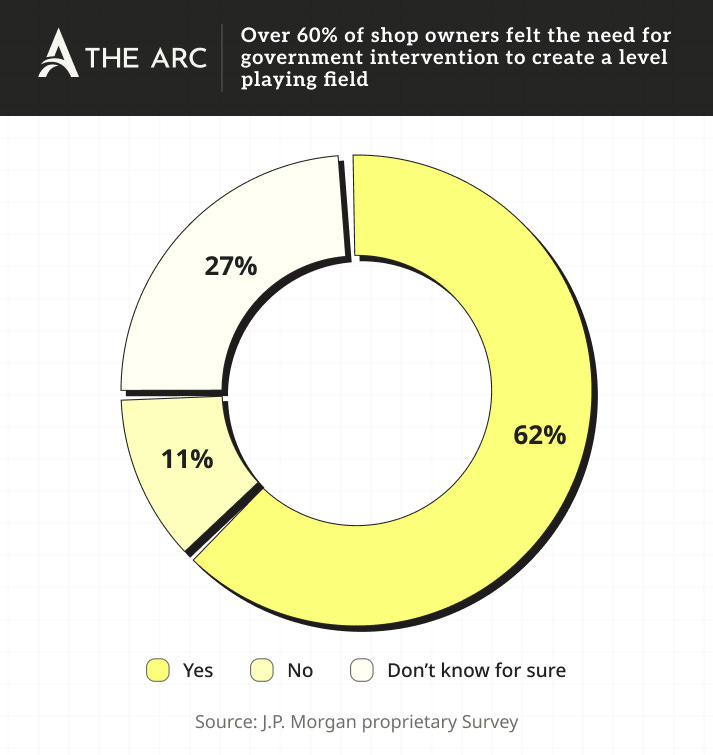

Beyond speed: Where quick commerce goes in 2025. Check out this long read at The Arc. The TLDRs: more scrutiny, focus on customer retention, pressure on leadership teams to deliver and regulatory risks.

Amazon exited retail chain Shoppers Stop by selling a 4% stake in the company for Rs 276 crore through an open market transaction.

🍕D2C Snippets

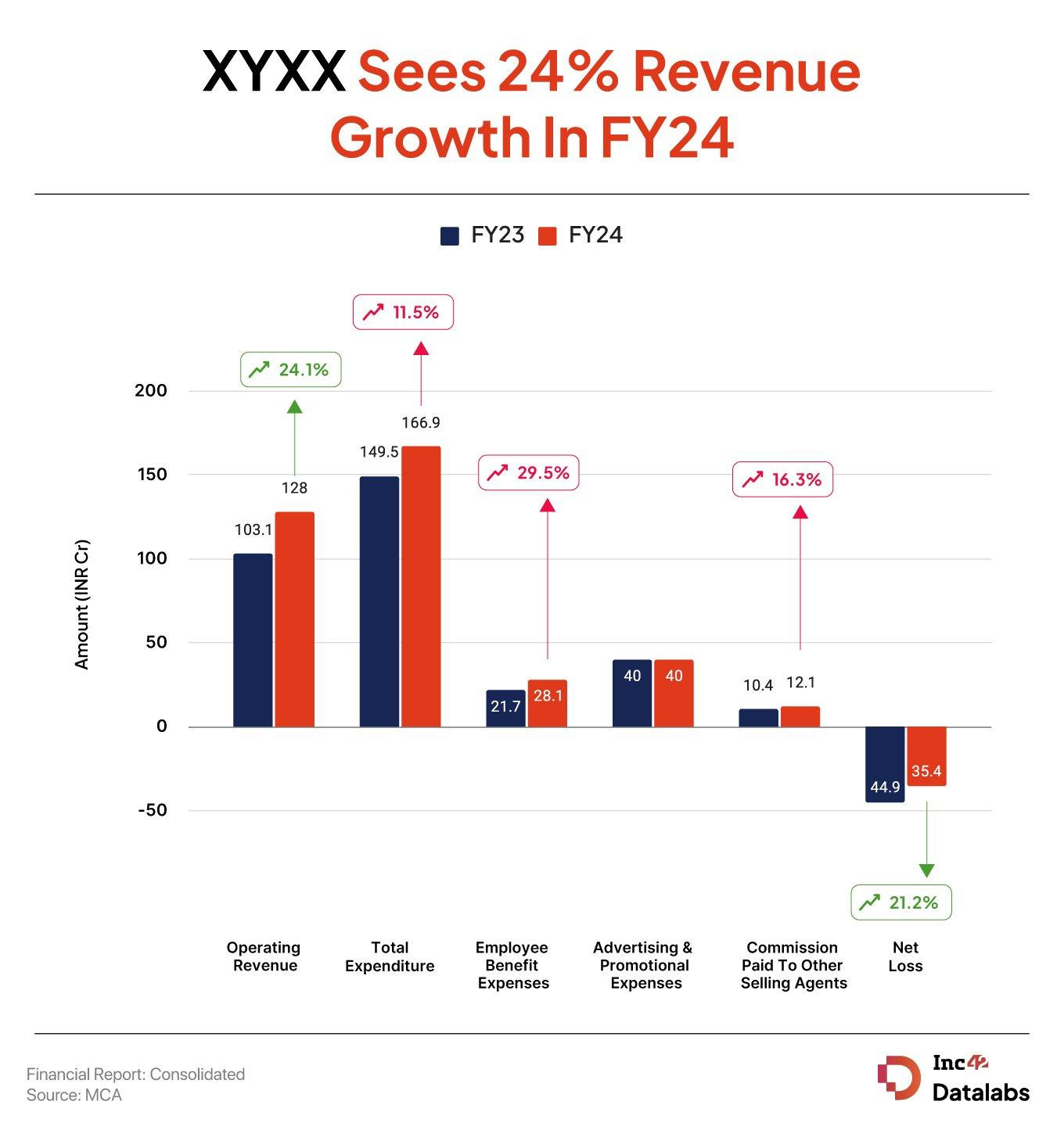

D2C menswear brand XYXX managed to reduce its net loss for the financial year ended March 31, 2024 (FY24) by 21.16% to INR 35.4 Cr from INR 44.9 Cr in the previous fiscal year, as its top line grew and margins improved. The startup’s operating revenue jumped 24.15% to INR 128 Cr during the year under review from INR 103.1 Cr in FY23.

Curls Win: Delhi NCR-based Arata has secured $4 Mn in Series A funding. The company will use the funds for product innovation, consumer research, and expansion of its distribution channels. Founded in 2018, Arata’s hair care products are currently available across its website, marketplaces, and quick-commerce platforms.

Bombay Shaving Company crossed Rs 200 Cr revenue in FY24; cuts losses by 22%. Bombay Shaving Company’s revenue from operations surged 27.38% to Rs 225.85 crore in FY24 from Rs 177.30 crore in FY23. Bombay Shaving Company competes with Ustraa, Beardo, and The Man Company in the grooming segment. Ustraa reported a 2.94% revenue decline to Rs 94.02 crore and a loss of Rs 50 crore in FY24. Meanwhile, Beardo’s revenue from operations rose to Rs 173.2 crore, and The Man Company saw a 58% increase in revenue, reaching Rs 182 crore.

🚩Insights

People Are The New Brands. An excellent long read. Some excerpts…

TikTok is an endless stream, not of landscapes or products or experiences, but of people. Same for YouTube, where the highest-performing videos are those with thumbnails featuring a giant human face. Meanwhile, on Instagram, pictures with human faces are 38% more likely to get a like than those without. The algorithm is the truest reflection of our cravings, and the algorithm has been very clear: We crave people the most.

Research shows Gen Z views their favourite influencers in the same way they view their friends. We know what clothes they wear, what food they eat, and what brands they buy. This has radically transformed the retail economy, so much so that 40% of them now consult an influencer before they make a purchase.

Joe Rogan has become more influential than the world’s largest news networks. His podcast gets 3x more downloads than the average primetime viewership of CNN and MSNBC combined. The key distinction between CNN and Joe Rogan is that one is a brand and the other is a person.

Last year, MrBeast racked up more than 1 billion hours of viewing time, more than any of the top shows on Netflix. He’s one of the millions of YouTubers swinging the pendulum of power away from brands and toward individual people.

The corporate world has started to wake up to the power of the person, but the movement was started years ago by Elon Musk. Meta’s worst rebrand happened three years ago when the company tried to wash away its sins by switching from Facebook to Meta. Its best rebrand, however, came this year, when Mark Zuckerberg went from awkward coat-and-tie-wearing Senate-hearing prop, to gold-chain-donning T-Pain-loving jiu-jitsu fighter.

📚Reads and Recommendations

Understanding FMCG markups and markdowns, and the Shah Rukh Khan of margins.

A brief history of venture capital and an interesting take on where it’s headed. TLDR: Capital agglomerators face a rough reality. There are probably NOT enough generational companies to justify having $3B+ funds every few years.

The agentic revolution is upon us. The state of the AI Agents ecosystem: The tech, use cases, and economics

Why do retailers love gift cards? It’s not the convenience but the 19% that goes unused.

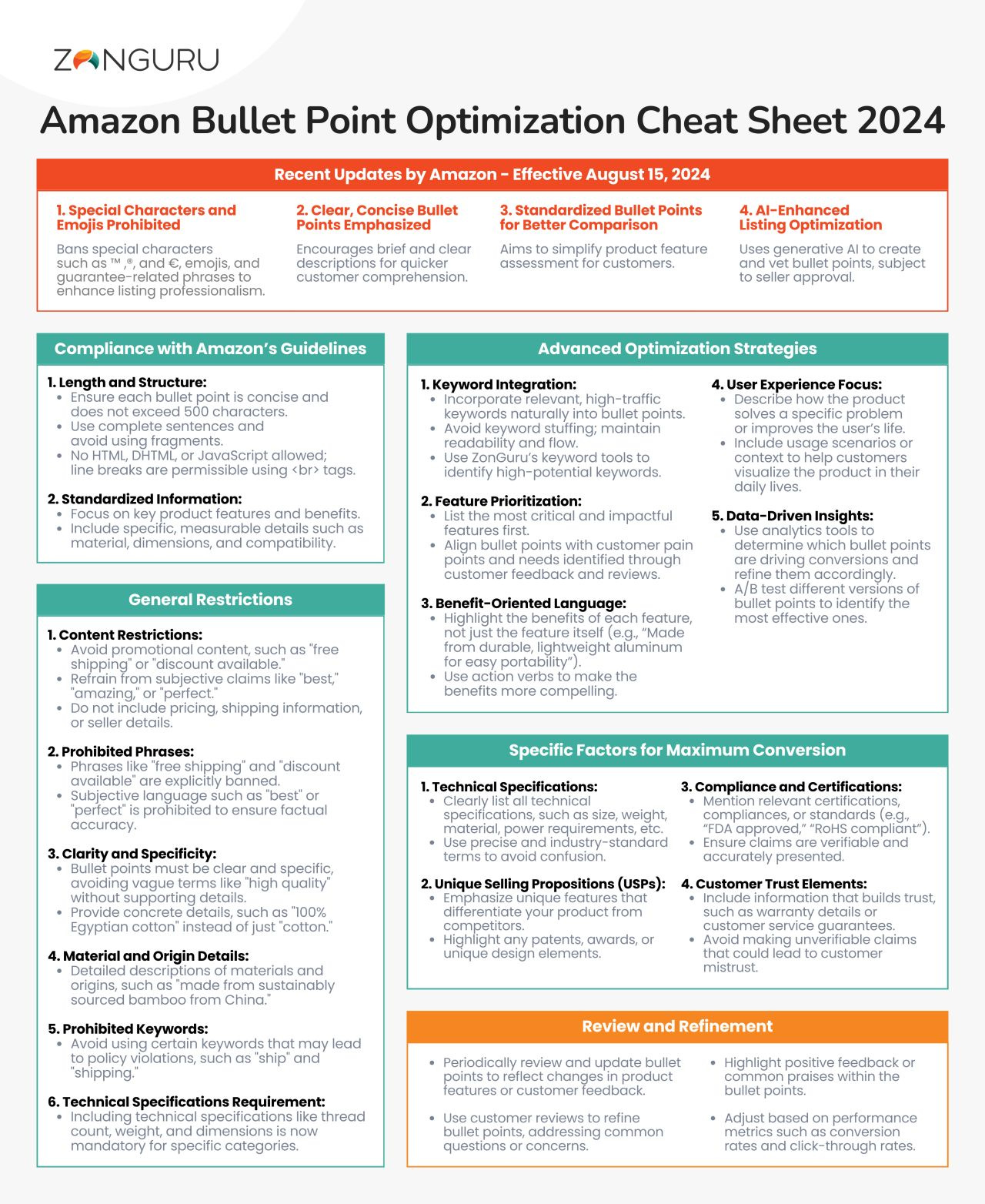

Amazon bullet point optimisation checklist courtesy Jonathan Tilley

That’s all for this week! Merry Christmas!

Folks at some companies have told us this newsletter is almost mandatory weekly reading for their teams 🥰. If your company is not in on it yet, get your teams on the latest in the e-commerce space every week.

Stay tuned for more.

Liked this week’s issue? Share it with your pals.