🔍The MRI of Indian Startup Space

Speed Up, Buyback, Expansion Scoop, Insta's Dislike, Meesho Creators

Hi Surgies 👋

Blume’s Indus Valley Annual Report is out. Like every time it’s an MRI of the Indian Startup Ecosystem. Every other page is fodder for a longish post-work evening discussion over coffee/beer/gin/whisky (nope, not cocktails).

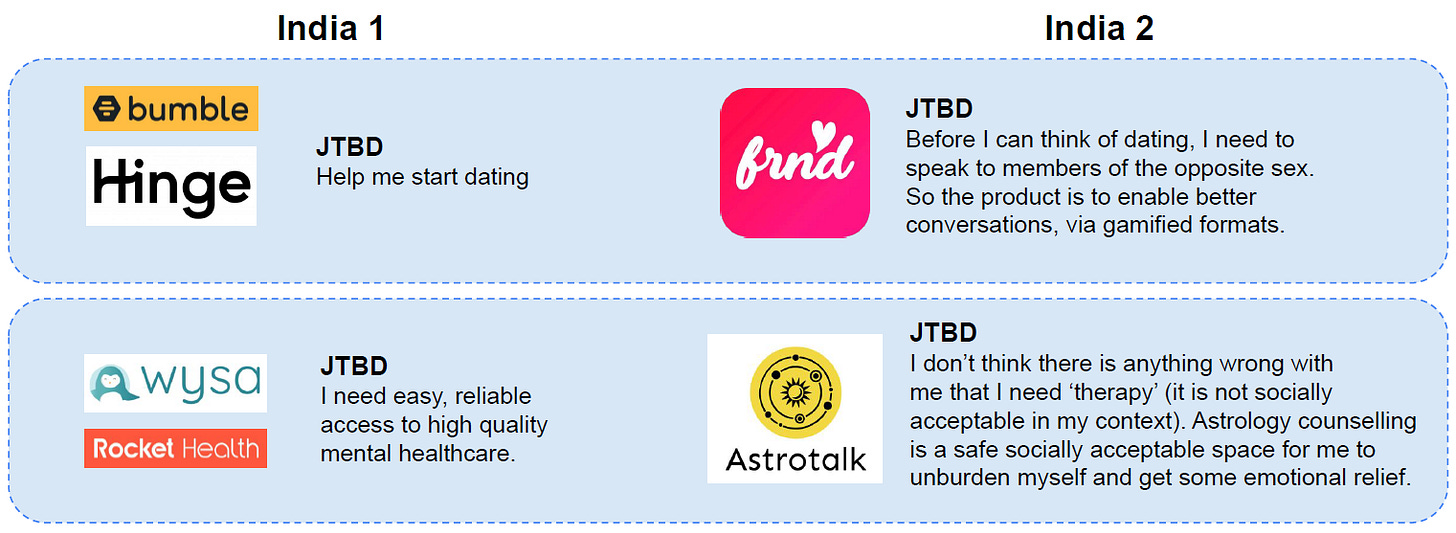

Interesting take with a JTBD playbook to build products for India 2.

The section on targeting the Indian diaspora is refreshing. It was great to see the note being vocal about poor address infrastructure costing India billions.(and how startups like Gokwik are solving for it)

There's a whole section on quick commerce with insights like

India seems to be leapfrogging Modern Retail and going directly to quick commerce

Qcomm becoming FMCG’s fastest growth channel

Ads contributing a meaningful margin.

… reiterating that quick commerce is decimating distribution moats and creating a level playing field (well almost) for D2C brand and FMCG players

🗞️Marketplace Buzz

💰 Udaan has raised $75 million maintaining a flat valuation at $1.8 billion. The funds will enhance customer experience, deepen market reach, and strengthen supply chain capabilities. An additional $25 million investment is anticipated next quarter. This move aligns with Udaan's plans for a potential IPO in 2026.

Shiprocket is transitioning from a logistics provider to a comprehensive digital commerce enabler. The company has recently converted into a public entity, a strategic move in preparation for its anticipated IPO in the upcoming fiscal year. Today, the company caters to more than 150K sellers and provides a bouquet of services ranging from hyperlocal deliveries to international shipping.

⚡ Tata to BigBasket: Speed Up or Get Left Behind! Tata Sons isn’t thrilled with BigBasket’s slow play in quick commerce, especially with Blinkit & Zepto racing ahead. To stay competitive, Tata has one piece of advice: Raise up to $1B in external funding! With the 10-min grocery wars heating up, will BigBasket shift gears or risk falling behind?

🎥 Meesho has unveiled a 'creator marketplace platform' to enhance its influencer-driven content commerce. Notably, over 14 million purchases on Meesho last year were influenced by collaborations. The platform introduces features like the Meesho Creator Club, offering real-time analytics and faster payouts to influencers, Video Finds for engaging product videos, and Live Shop sessions for real-time product showcases.

🚀Swiggy is allocating ₹1,000 crore to its subsidiary Scootsy Logistics to bolster its quick commerce operations. This investment aims to enhance warehouse management, order fulfilment, and the expansion of dark stores. Previously, Swiggy invested ₹1,600 crore in Scootsy in December 2024.

💰 PaisaWapas saw a 24% revenue jump to ₹68.7 Cr in FY24, with net profit rising 16.7% to ₹3.5 Cr. Affiliate commissions & ads drove 97% of earnings, while cashback expenses dropped 14.6%. Despite ad spends doubling, the platform remains profitable & expanding. Competing with CashKaro & CouponDunia, PaisaWapas is scaling fast.

🍕D2C Snippets

👓 Lenskart is gearing up for an IPO with a target valuation of $10 billion, doubling its previous funding round's valuation. The omnichannel eyewear retailer plans to file its draft papers by May 2025, aiming for a public listing within the year.

📈 The Ayurveda Co.'s revenue climbs, losses triple. The company reported a 66% increase in revenue, reaching ₹59.6 crore in FY24, up from ₹36 crore in FY23. However, losses surged 3.2x to ₹68 crore during the same period. Despite securing approximately $16 million in funding, TAC faces challenges in a competitive market.

Bringing global brands to India is the trend du jour! 🚀 Moksha Retails Global, led by Rehan Shaikh has brought in Carrera’s portfolio of wireless chargers, hair dryers, brushes and trimmers. Binny Bansal’s UnlockIndia has brought in GT Player - a lead gaming chair brand and Carote, a kitchenware brand. GlobalBees has exclusive distribution for Ecovacs (Robotic vacuum) and Kuvings (Cold pressed juicer). This space is heating up with more players getting into the fray.

👔Rare Rabbit, a premium fashion brand under House of Rare, has raised ₹50 Cr. In FY24, Rare Rabbit reported a 69% revenue growth to ₹636 crore, with profits more than doubling to ₹74.6 crore. The brand operates over 100 stores across India. Under the parent company House of Rare, Rare Rabbit has expanded into women’s clothing (Rareism) and children’s clothing (Rare Ones).

What’s cooler than a reverse flip? Buyback! Sirona Hygiene's founders, Deep Bajaj and Mohit Bajaj, have reacquired the women's wellness brand from the financially troubled Good Glamm Group. This buyback, valued at approximately ₹150 Cr, includes debt repayments incurred during Sirona's tenure under Good Glamm's ownership. The decision comes shortly after Good Glamm acquired Sirona for ₹450 Cr in October 2024.

Additionally, The Good Glamm Group has sold its digital media subsidiary, ScoopWhoop, to Bengaluru-based marketing agency WLDD for ₹18-20 crore- significantly lower than its ₹100 crore acquisition price in 2021. Facing financial challenges, the company has also considered divesting POPxo, and MissMalini.

This saga has sparked quite a discussion across WhatsApp groups, Shantanu sums it up in this post.

🍖Online meat & seafood brand Licious is prepping for a 2026 IPO, chasing a $2B+ valuation. To get there, it’s going beyond digital—targeting 500 new stores in five years & expanding its ready-to-cook/eat range. Despite a revenue dip to ₹6.87B in 2024, it’s trimming losses fast—down to ₹2.98B from ₹5.29B last year. Will Licious cook up a blockbuster IPO or get grilled by the markets?

🥜 The Whole Truth, has raised $15 Mn in funding. Founded in 2019 by ex-Unilever marketer Shashank Mehta, the company offers clean-label products like protein bars, peanut butter, dark chocolates, protein powders, and muesli. The new funds will enhance in-house manufacturing, talent acquisition, and category growth.

🎉Pop culture fashion brand The Souled Store just pulled off a profit-making plot twist—revenue soared 54.5% to ₹360 Cr in FY24, flipping last year’s ₹16.5 Cr loss into a ₹18 Cr net profit. Founded in 2014, the brand blends superheroes, movies & TV nostalgia into apparel, now sold across 18 stores in India. From losses to wins-a true underdog story!

🍦 NOTO Scoops Up ₹15 Cr for Expansion! The Mumbai-based ice cream brand backed by actor John Abraham, has secured ₹15 Cr. Founded in 2019, NOTO is known for its low-calorie ice cream offerings. The fresh capital will be utilized to enhance its offline retail footprint, aiming to make its products more accessible to health-conscious consumers across India.

🐶 Dogsee Chew, a Bangalore-based pet treat company, has secured $8 Mn in a Series B funding round. The fresh capital will support the brand's expansion into the U.S. and Canadian markets in 2025, aiming to meet the growing demand for natural pet treats. Known for its hardened cheese-based chews, Dogsee Chew continues to innovate in the pet care industry.

📚Reads & Recommendations

💎 Luxury industry is facing an existential crisis after Covid

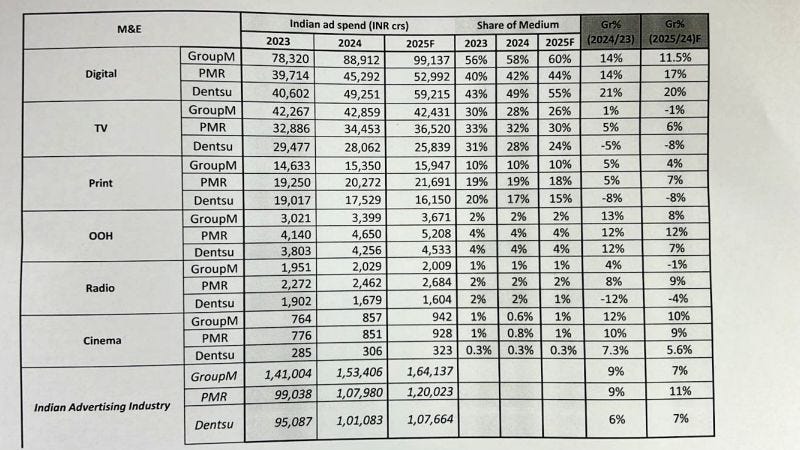

📈 Someone did the hard work to collate the Ad spend split put across by various agencies. Net-net, digital is on a roll, TV is stagnating and Print is hanging with its fingernails.

Why Etsy’s strategy to sell handmade, artisanal goods online is not working.

Instagram’s test of a “dislike” button on comments and how it may affect your life.

🔥That’s all for this week! As always, share this with your fellow D2C hustlers, and let’s keep the community growing.

Folks at some companies have told us this newsletter is almost mandatory weekly reading for their teams 🥰. If your company is not in on it yet, get your teams on the latest in the e-commerce space every week.