Hi, Surgies 👋

It’s New Year’s Eve tomorrow, to an eventful year in the e-commerce world. It was a year when Quick Commerce came to the fore. In the last 90 days, a week didn’t go by when we didn’t see a new launch by a new player into the ecommerce Game of Thrones, incumbents launching in new cities and opinion pieces on qcomm economics. The bikers in Yellow, orange and purple jackets are visible everywhere while dark stores pop up in new localities.

Meanwhile, D2C brands have seen their fair bit of action (most of which we’ve covered in the weekly newsletter). Speaking of brands, here’s what the good folks at India Quotient want to invest in:

A Zara-like shopping experience at Zudio prices

Scaled kids brand in toys, clothes and personal care

B2B brand disruptors ( new age Fevicol, Greenply, Havells)

White goods for rural India

🗞️Marketplace Buzz

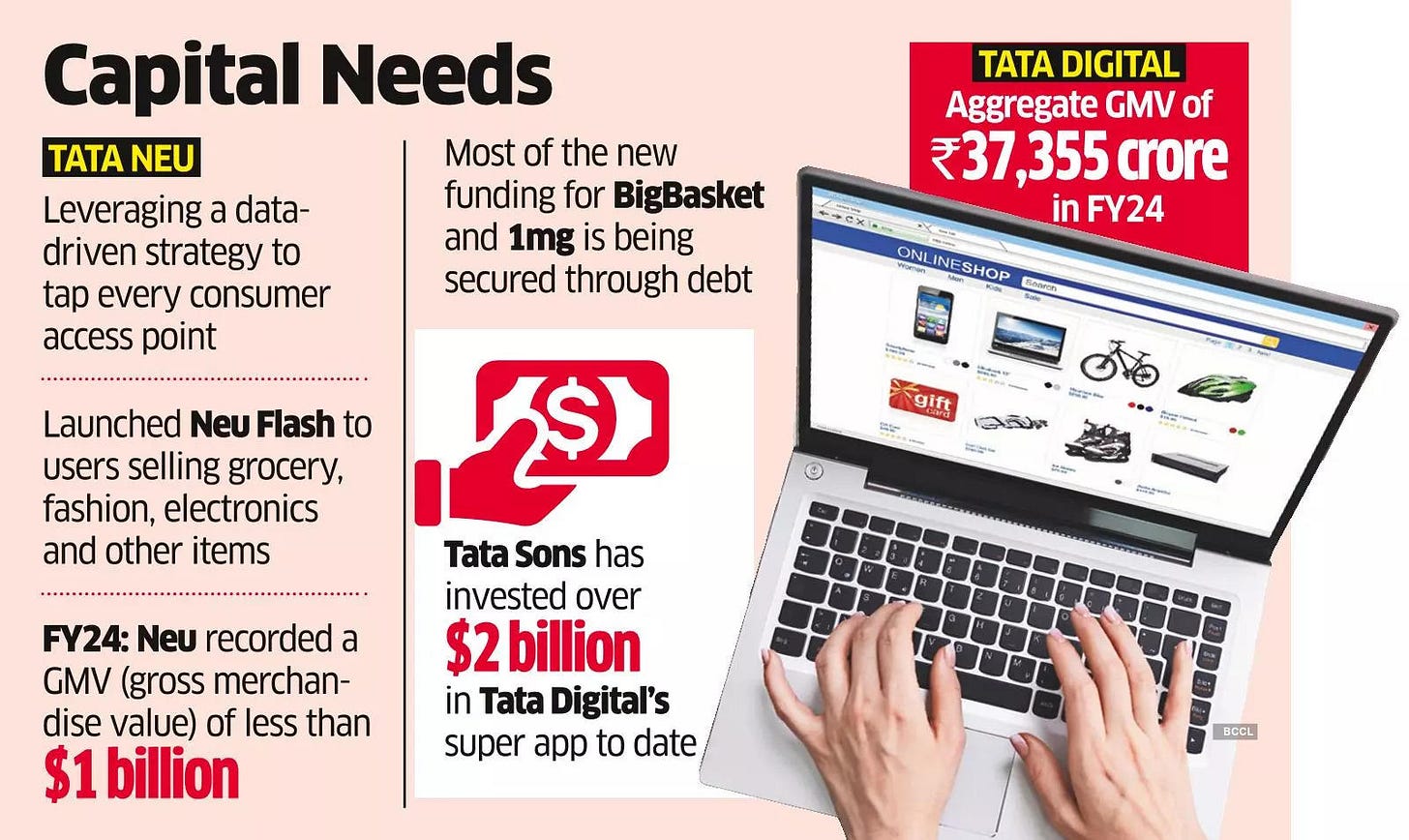

Tata Digital seems to be in a funk. Tata Sons may infuse the next round of capital into its ecommerce business, Tata Digital, only in mid-2025. Until then, the new commerce entity will have to rely on internal funding and debt financing to fuel growth. Tata Sons has invested over $2 billion in Tata Digital's super app to date.

Tata Neu is now aggressively leveraging a data-driven strategy to tap every consumer access point within the system, including partnerships with external entities.

BigBasket is eyeing an IPO and significant growth in standalone revenues for FY24. The Bengaluru-based firm is spending most of its capital on quick commerce following its pivot to the 15-30 minute delivery service.

Tata CLiQ, recently has undergone a rebranding, changing its name to Tata CLiQ Fashion

The intense rivalry between Amazon and Walmart will continue into 2025. Over the years, these titans fiercely competed for consumer loyalty, market dominance and innovation leadership. Price wars between Amazon and Walmart gathered steam as both retailers intensified their discounting strategies to appeal to budget-conscious consumers. Both companies also ramped up their quick commerce initiatives, with Amazon testing 15-minute grocery deliveries in India to compete directly with Walmart-backed Flipkart.

B2B e-commerce platform ShopKirana has struggled to scale in the last fiscal year as the company’s gross revenue fell by over 6%. However, the company reduced its losses by over 30% in FY24. ShopKirana is a B2B e-commerce platform that connects retailers and brands directly through a mobile app and helps them in placing orders, maintaining inventory, optimising the delivery routes and making payments. Besides helping in procurement, the platform provides financial services such as banking and loan facilities.

Blinkit reported trends in India’s 2024 shopping habits. A ton of fun stats here:

Maggi remained a beloved staple, with 1,75,64,980 packs ordered,

Someone bought 1,203 bottles of Sprite in a single purchase.

looks like gin is on the rise as 37,82,261 tonic water cans were ordered.

🍕D2C Snippets

Overall on the funding front, D2C brands raised $595 Mn across 115 deals in 2024, a steep decline from $1.4 Bn from 134 deals in 2023. The average ticket size across stages also plunged by 66% (65.68%, to be precise) to $4.18 Mn this year from $12.2 Mn in the previous year. Seed Funding is going pretty strong, growth & late-stage deals were down.

Meanwhile, Debt funding is playing an important role. Revenue as well as cash-flow-based alternative debt financing platforms like Velocity, Indifi and GetVantage are redefining funding access with data-driven financing solutions. These platforms assess real-time sales data, GST returns, bank statements and digital transactions to provide non-dilutive working capital without collateral.

VCs. Revenue-based debt financing differs from the more popular venture debt model.

Most venture debt funds require a company to provide warrants to the venture debt lender. This means shareholders will experience dilution with venture debt. Also, one must pay high interest rates, repay the money within a short tenure and return a fixed amount every month regardless of the cash flow.

In contrast, repayments are flexible in revenue-based debt financing and calculated based on the revenue earned by the debtor in the preceding month.

The VC crystal bowl sees a maturing ecosystem, improved execution, lesser marketplace dependence, AI playing a role and rural demand.

To the sun and back. Mamaearth delivered 99.2M+ products nationwide in 2024. The company has had a mixed year, with the stock on a tear for the better half and then falling, with the firm reporting its first loss in five quarters. The management declared that the offline strategy needed a re-config after the distributor woes and dead stock rose in the channel.

📢Power Talk

"We commit to take the number of women delivery partners to at least 1 lakh by 2030.” Sriharsha Majety, CEO & Cofounder, Swiggy

📚Reads and Recommendations

Sales forecasting 101. Factor in multiple vectors- historical data, seasonality, competition, pricing.

HUL, Dabur, Marico and Godrej scaled back ad expenses in Q2 FY25. Data from TAM AdEx shows that FMCG companies’ advertising volumes on television declined by 6% in the first half of 2024. However, digital ad impressions bucked this trend, rising by 7% over the same period in 2023.

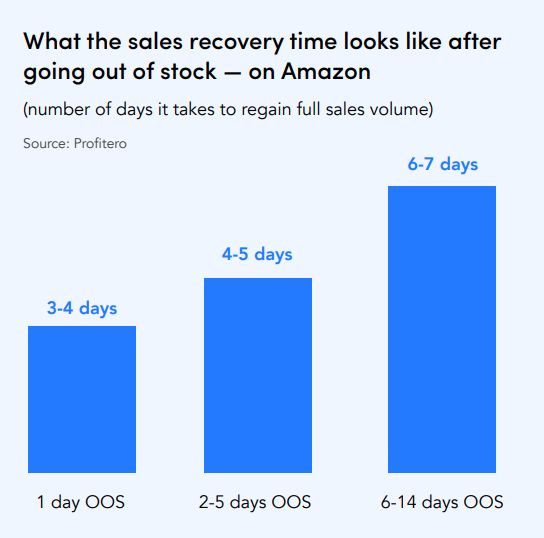

If you are low on stock on Amazon for 1 week, you lose 42% sales.

The consumer landscape has been paradoxical in India this year- on one hand, a slowing economy and sagging private consumption, and on the other, an unmistakable shift toward premium products.

KPI Check. D2C peoples, hope you’re them.

Taylor Swift wore this brand’s $60 activewear skort. Here’s what happened next. A one-second clip of the pop star wearing PopFlex’s lavender Pirouette Skort led to a level of virality it couldn’t have prepared for.

That’s all for this week! Have a rockstar 2025!

Folks at some companies have told us this newsletter is almost mandatory weekly reading for their teams 🥰. If your company is not in on it yet, get your teams on the latest in the e-commerce space every week.

Stay tuned for more.

Liked this week’s issue? Share it with your pals.

Great, recap and insights! Much appreciated.

Very insightful